In 2013, the YoY growth rate of the world propylene glycol (PG) production was 8%. In the same year, the PG production exceeded 2.18 million tonnes. The growth of the PG production was spurred mainly by the startup of SCG-Dow PG unit (with capacity 150 000 tonne/year) in Thailand in early March, 2013. Meantime, the global average operating rates stood at around 77% in 2013.

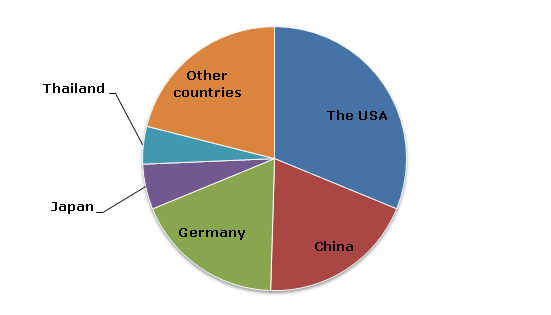

In 2013, the APAC and North American regions took lead in the world PG market in terms of production. In the same year, the USA, China, Germany, Japan and Thailand ranked the top five countries in terms of PG production; their combined share in the world’s total production was equivalent to 78.95%.

Propylene Glycol (PG): structure of the world production by country, 2013

Dow, Lyondell Chemical Company, Global Bio-Chem Technology Group Company, Ineos Oxide, Nihon Oxirane, SINOPEC Zhenhai Refining & Chemical Company, Archer Daniels Midland, SKC Chemicals Group, Shell Eastern Petroleum, Arrow Chemical Group and BASF AG are among the dominant players in the global PG market.

There is also a novel trend in the world PG market: the production of monopropylene glycol from bio raw materials. Some companies, including BioChem Technology Group, Archer Daniels Midland Company and Oleon NV, are already engaged in the production of PG from renewable feedstock.

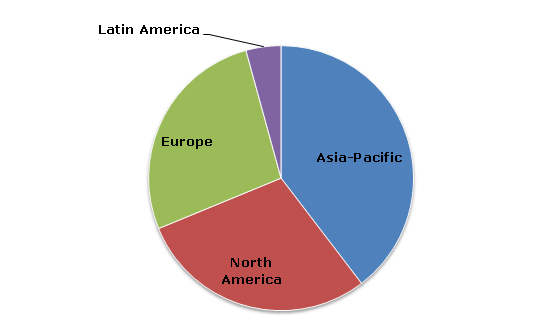

The world annual PG production capacities stood at around 2.81 million tonnes in 2013. In the same year, APAC and North America called for 39.61% and 29.18% shares of the total figure, respectively.

Propylene Glycol (PG): structure of the global production capacities, 2013

Through 2018, the world PG market is poised to register positive growth (by around 4.5% per year). The largest contribution to the market growth is expected to be made by China and some other emerging regions. The APAC PG market is forecast to grow by 7% annually through 2018. Moreover, future investment in new plants will mainly be targeted in the APAC region. By 2015, the world PG market is anticipated to reach the production-consumption balance.

In the next 4 years, the major part of PG output will still be produced from petrochemical raw material. However, novel technologies for obtaining bio raw materials for PG production are being developed today.

More information on the propylene glycol market can be found in the research study “Propylene Glycol (PG): 2014 World Market Outlook and Forecast up to 2018”.