The term ‘nitrile rubber’ (NBR) encompasses a group of synthetic rubber copolymers of acrylonitrile and butadiene with applications in cabling/belting, automotive finished goods (brake liners, dashboards, brake pads, etc), medical gloves, molded and extruded products, adhesives, sealants, footwear, fabrics, oil field products and other areas.

The NBR market is dynamic, innovation-intensive, susceptible to fast changes, and Asia-centered. NBR manufacturers have to promptly adapt their production by altering operating rates subject to demand fluctuations, size of margins, volatilities in raw materials supplies and costs, as well as other market conditions. Operating rates can vary from the sub-50% level to full 100% mark. For example, a year ago, in July 2014, many Chinese producers, like Ningbo Shunze Rubber (NBR capacity: 50,000 tonne/year), had to run their NBR plants at reduced rates of 40-45% because of weak market conditions and poor margins. Reversely, in July 2015, when the NBR market in Asia Pacific faces soaring feedstock butadiene (BD) prices and firm domestic demand, the operating rates peaked to the utmost 100% capacity.

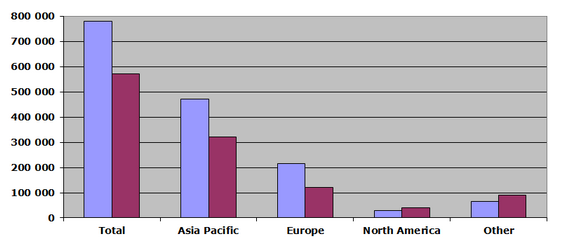

Nitrile rubber (NBR): structure of the global capacity and consumption by region, 2013 (metric tons)

In general, despite added or planned BD capacities, BD shortage may become a steady trend when synthetic rubber demand picks up, which tightens up the BD market and increases BD prices. However, BD price fluctuations generally follow complex trajectories influenced by interrelated factors of capacity expansions (idled BD facilities in Asia Pacific are also at play), economic viability, supply-demand balance and other factors.

Strong domestic demand for NBR in Asia Pacific can mean firming feedstocks and fewer imports coming from the region to Europe, so European sellers will start rising prices and experience some supply shortage, which signifies strong interrelation between different regional NBR markets. Despite this interrelation, there is a certain inter-regional ‘demarcation line’ which distinguishes Europe, the USA and other developed countries from other regions and which shows that in Europe and the USA the synthetic rubber industry develops mostly along qualitative (backed by technological innovations), rather than quantitative parameters. However, it should be borne in mind that such geographical boundaries are starting to blur as technological innovation becomes almost a universal trend among NBR-producing companies from various regions, and it is possible now to talk only about the level of this innovation.

Experts anticipate that the global demand for NBR will grow at 5.9% up to 2018. Some regional variance in growth pace will be exhibited: in China the demand is predicted to grow by 7.6% per year, which is considered a very optimistic scenario. In short-term perspective, NBR consumption will globally increase by 4% annually. Asia Pacific will show the highest growth rates in terms of both NBR production and consumption (only a few capacity additions are planned in next five years and two of them will take place in China), while Europe and North America will demonstrate sluggish growth. The shares of North America in global NBR consumption and production capacity are quite small (7.17% and 3.85%, respectively) as NBR at this market is actively substituted by other products, such as thermoplastic polyester elastomers and thermoplastic polyolefins. Global nitrile rubber output is expected to reach 700 000 by the end of 2018.

Asia Pacific region will retain its leading position in NBR output volume. The future of the NBR market is quite bright, especially in the automotive and medical sectors (despite the fact that medical and research personnel still prefer traditional latex gloves in majority of applications), though periodically rising feedstock prices and environmental concerns may act as its detrimental factors.

More information on the nitrile rubber (NBR) can be found in the in-demand research report “Nitrile Rubber (NBR): 2015 World Market Outlook and Forecast up to 2019”.