Polypropylene is a versatile bulk-commodity thermoplastic polymer with the largest consumption areas in the packaging industry, household goods and automotive industry. The global polypropylene consumption in these sectors will behave differently during the period from 2015 to 2025: it will grow from 45% to 49% in the packaging sector, drop from 33% to 29% in the household goods sector and rise from 17% to 19% in the automotive industry.

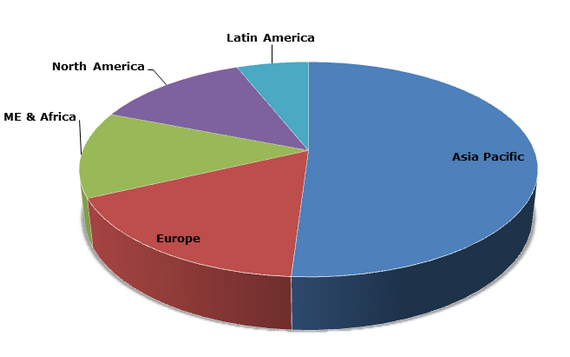

There are some general trends that can characterize the development of the polypropylene market in the coming years. The segmentation of the global polypropylene market will be multidimensional subject to specific region (both intraregionally and interregionally), polymer type or consumption sector, to name only a few. The Asia Pacific region will remain to account for half of global polypropylene production capacity, while China alone will account for 25% of the world polypropylene capacity.

Polypropylene production capacity by region, 2014

Asia Pacific will be the largest polypropylene-consuming region, together with other growing economies that will lead the global demand for polypropylene and demonstrate the highest CAGRs. China will continue to import large polypropylene volumes and specific polypropylene grades, though this country will become more self-sufficient with respect to polypropylene. Low cost feedstocks (like availability of shale gas) may increase the role of North America in polypropylene exports, which will be backed by developed refining/transportation infrastructure and advanced US technologies licensed by such companies as LyondellBasell Industries. Polypropylene consumption will exhibit large intraregional variance. For example, in eastern parts of India the polypropylene consumption is the lowest and accounts for just 10 per cent of the domestic level. In Russia, dependence from polypropylene imports varies subject to polymer type and consumption market. For instance, the largest segments of polypropylene imports in Russia include piping products and films, as well as random copolymers and block copolymers.

The polypropylene market also witnesses capacity rationalizations with plants closures (mostly in Europe) and a general move towards larger plants, mega projects, integrated petrochemical complexes and huge production volumes from single sites. Major projects will be implemented in the following regions (incl. company name, planned capacity in tonnes per annum, and year of commissioning): the USA (Formosa Plastics: 600,000 tpa, in 2017; RexTac: 700,000 tpa, in 2019), India (IndianOil Corporation Ltd.: 700,000 tpa, in 2018), Vietnam (Petrovietnam, Siam Cement and Qatar Petroleum: 2.7 mln tpa of polyethylene and polypropylene, in 2019; Nghi Son Refinery Petrochemical: 700,000 tpa, in 2017), Brazil (Petrobras: unknown, in 2018), Oman (Oman Oil Refineries & Petroleum Industries: 1 mln tpa of polyethylene and polypropylene, in 2018), Russia (ZapSibNeftekhim, a subsidiary of Sibur: 500,000tpa, in 2019), Turkmenistan (Turkmengas: 81,000 tpa, in 2018), Kazakhstan (Kazakhstan Petrochemical Industries: 450,000 tpa, in 2016), and Azerbaijan (SOCAR: 180,000 tpa, in 2016).

One of the main trends related to the future development of the polypropylene market lies in the innovation of polypropylene-manufacturing technologies, which will help to expand the range of high-quality polypropylene products, originate novel resins with improved properties and performance, raise product quality, minimize production costs, increase flexibility in relation to capacity utilization rates, enable advanced tailoring of product properties and composition to address specific application needs, and positively affect all major product fields like homopolymers, random copolymers and heterophasic copolymers. Another trend is the improvement of services related to the whole process of polypropylene manufacturing, like dedicated support available during project implementation, start-up, operation and optimization for production licenses.

More information on the polypropylene market can be found in the insightful research report “Polypropylene (PP) 2015 World Market Outlook and Forecast up to 2019”.