The global propylene glycol production has a distinctive structure. There is quite a big capacity gap between the top two manufacturers (Dow Chemical with 920,000 mt/y and Lyondell Chemical with 410,000 mt/y in propylene glycol capacity) and the rest, represented by multiple smaller (sub-100mt/y) players, like Archer Daniels Midland Co., (USA), SINOPEC Zhenhai Refining & Chemical Company (China), Nihon Oxirane Co Ltd. (Japan), SKC Chemicals Group (South Korea), Tongling Jintai Chemical Industry Co., Ltd. (China), etc. These two companies jointly accounted for over 43% of total global propylene glycol capacity of 3,063,000 mt/y recorded in 2014.

However, the propylene glycol market could hardly be called heavily monopolized or controlled by few players, taking into consideration great number of fairly large manufacturers, the wide geographic spread of their capacities, and well-balanced character between production and consumption.

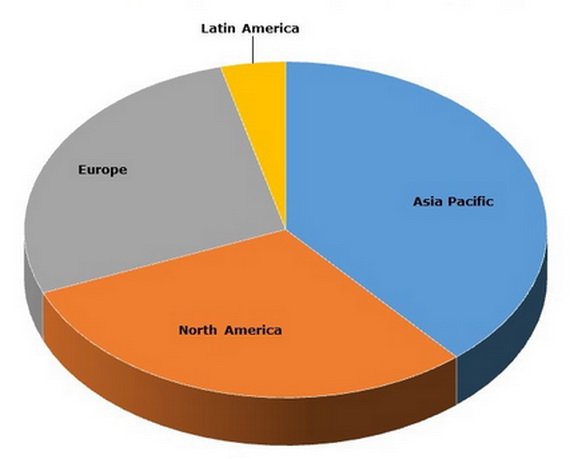

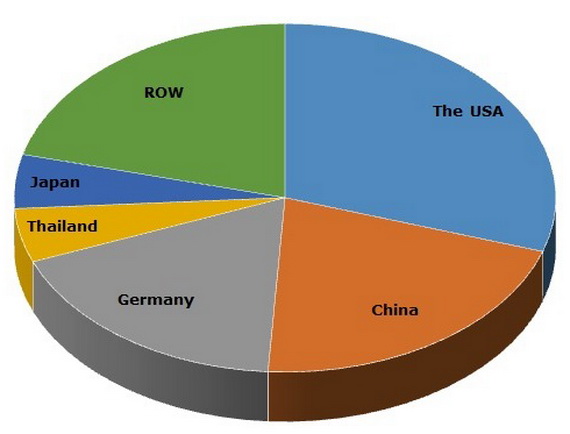

In the chain of ‘region-country-manufacturer’, one can observe that propylene glycol production leadership migrates from the Asia Pacific region (though closely followed by North America and Europe) through the USA, outperforming China and Germany, and to such market heavyweights as above-mentioned Dow and Lyondell, whose propylene glycol facilities are located in many countries.

Propylene glycol (PG): structure of the global production by region, 2014

Propylene glycol (PG): structure of the global production by country, 2014

For instance, Dow keeps the bigger share of its propylene glycol capacity outside the US (specifically in Germany, Thailand, Brazil and Australia), while Lyondell, though not quite following the suit, still has a large portion of its propylene glycol capacity in France and Netherlands. Dow is also experienced in creating proprietary vertically-integrated feedstock chains. Currently, it is building, in cooperation with Saudi Aramco, the world’s largest integrated petrochemical complex in Al Jubail Industrial City (Saudi Arabia), which will manufacture propylene oxide, a main feedstock for propylene glycol.

It is ascertained here that such propylene glycol production split will have a tendency to persevere at least in the medium-term perspective. Despite the dominance of Asia Pacific in the demand for propylene glycol, the current economic slowdown in China and continuing stock market fall in this country, followed by the closure of some foreign manufacturing facilities, will be instrumental behind keeping intact the current structure of propylene glycol production.

A separate position is taken by such companies as Global Bio-Chem Technology Group (Hong Kong, China; PG capacity: 200,000mt/y) or Oleon N.V. (Belgium; PG capacity: 20,000 mt/y, under cooperation with BASF), which operate on the market for bio-based propylene glycol. Though Global Bio-Chem Technology features rather significant propylene glycol capacity and major applications for its propylene glycol including unsaturated polyester resins, heat transfer fluids and solvents, over 90% of propylene glycol is still petroleum-based. There is no significant evidence to convince that in any foreseeable future this trend will reverse and bio-based propylene glycol will start to substitute petroleum-based, despite new capacities for bio-based propylene glycol are constantly added by various market players in order to address the rising demand for more environmentally friendly chemicals.

More information on the propylene glycol market can be found in the in-demand report “Propylene Glycol (PG) 2015 World Market Outlook and Forecast up to 2019”.