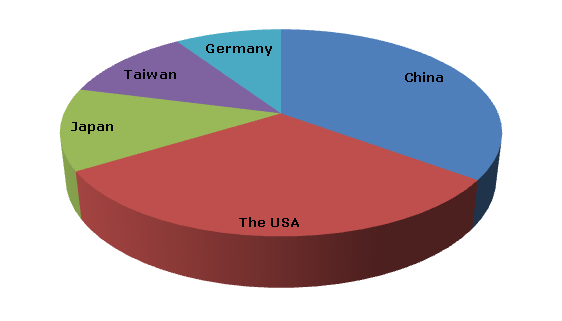

In 2012, the world VAM production increased by nearly 4.5% and climbed to approximately 6.3 million tones. In the same year, the global capacity utilization rate stood at around 89% in average. Asia took the leading position in the world in terms of VAM production volume. The region called for 53% (over 3.32 million) of the world VAM output in 2012; China alone accounted for nearly 27% of the world’s total VAM production volume. Meantime, North America and Europe held a 24% share and a 16% share, respectively. In 2012, top five VAM manufacturing countries (namely China, the USA, Japan, Taiwan and Germany) together accounted for almost 78% of the world total VAM production volume.

Vinyl Acetate (VAM): structure of the global production by country, 2012

Celanese, SINOPEC, Dairen Chemical, Dow Chemical, EI DuPont de Nemours & Co, International Vinyl acetate (IVAC), LyondellBasell Acetyls, Ineos, Asian Acetyls (ASACCO) and Wacker-Chemie AG are among the top players in the world VAM market.

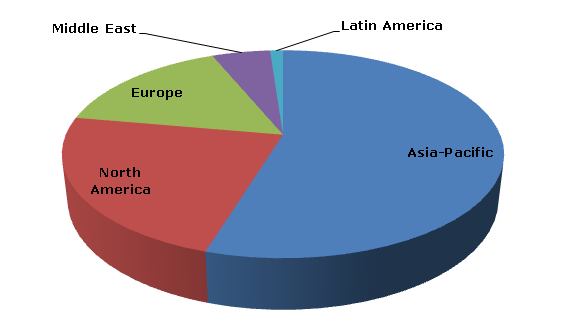

In 2012, the world annual production capacity of vinyl acetate (VAM) stood at more than 7 million tonnes. In the same year, Asia-Pacific accounted for almost 55% of the world’s total VAM production capacity. It was followed by North America and Europe with share equivalent to 23.06% and 15.98%, respectively.

Vinyl Acetate (VAM): structure of the global production capacity broken down by region, 2012

During 2010-2012, the world VAM consumption followed an upward trend, and in 2012 it surpassed 6.26 million tonnes. As of 2012, Asia accounted for around 60% of the world’s total consumption volume (it is more than North America, Europe and Latin America combined). Polyvinyl acetate and polyvinyl alcohol industries are the major VAM application areas; in 2012 nearly 89% of the world’s total VAM output was consumed in these spheres.

The world VAM production is poised for continuous growth by 4.5% (on average) in the next 4 years, driven mainly by China; it is predicted to exceed 7.8 million tonnes in 2017. The European VAM market is anticipated to slow its growth rates in the years ahead mainly owing to large amount of cheap VAM exported to the region from Middle East and the USA. Meanwhile, North America is expected to see a remarkable increase in the local VAM production.

More information on the vinyl acetate market can be found in the research study “Vinyl Acetate (VAM): 2014 World Market Outlook and Forecast up to 2018”.