Over 2007-2010, the world ethanol market has exhibited considerable growth primarily due to its’ expanding application area, namely renewable fuel. Furthermore, in 2011 and 2012 the growth in the global ethanol market slowed down given the unfavourable market conditions, especially in the US and Brazil.

As of 2012, the world ethanol supply volume reached 69.5 million tonnes, registering a 23% YoY decrease. In 2013, the ethanol market returned to the growth trend. The output volume of the world ethanol industry exceeded 72.5 million tonnes.

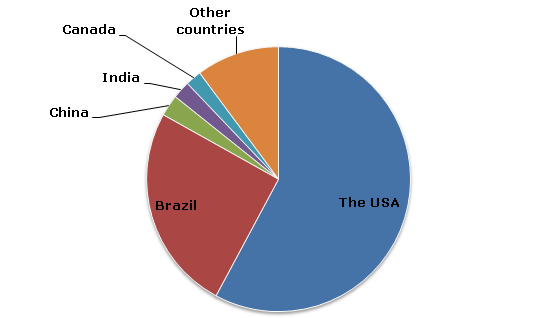

In 2013, North America accounted for the largest chunk of the world ethanol output; the region’s production volume stood at over 43.3 million tonnes in the year 2013. It was followed by Latin America and APAC. In the same year, top five ethanol producing countries (namely the USA, Brazil, China, India and Canada) called for 89.83% of the world’s total ethanol production.

Ethanol: structure of the global production by country, 2013

POET LLC, Archer Daniels Midland, Valero Energy Corporation, Abengoa Bioenergy Corp, Green Plains Renewable Energy, Flint Hills Resources, Big River Resources, Crop Energies AG, White Energy Holding Company, Aventine Renewable Energy, Biofuel Energy Corp, Tianguan Ethanol Chemical Group, Marquis Energy, Pacific Ethanol, Jilin Fuel Ethanol, Aracatuba Alcool SA, Cargill, Tereos and Tharaldson Ethanol are the top ethanol market players.

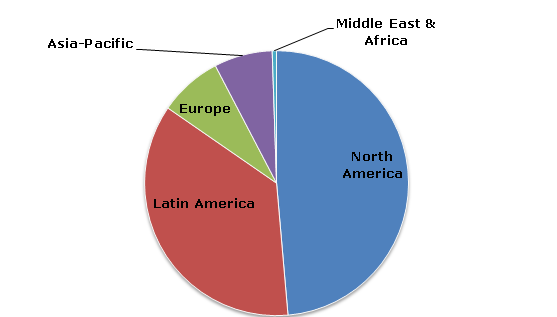

In 2013, the world annual capacity of ethanol production surpassed 94.51 million tonnes mark. In the same year, North America accounted for almost a half of the world capacities, followed by Latin America and Europe.

Ethanol: structure of the global production capacities by region, 2013

After a decline in 2012, the global ethanol consumption registered positive growth in 2013 and went beyond 72.5 million tonnes. North America was the leading ethanol consumer in 2013. The fuel ethanol industry is the major ethanol end-use sector, which consumed around 84% of the global ethanol output in 2013.

In 2018, the global ethanol output is predicted to exceed 100 million tonnes. The USA and Brazil are forecast to keep its top positions in ethanol production. Novel capacity introductions scheduled for 2014-2018 are likely to play essential role in meeting of the increasing global demand. Growth in the world ethanol market will also be supported by favourable regulatory policies, changes in economic situation and technological developments, among other factors.

More information on the ethanol market can be found in the research study “Ethanol (EtOH): 2014 World Market Outlook and Forecast up to 2018”.