In 2012, the volume of the global polyisobutylene consumption registered a 1% YoY decline and totaled just over 1.023 million tonnes. In the same year, Europe was the largest polyisobutylene consumer; the regions consumption volume stood at around 419 thousand tonnes in 2013. It was followed by North America. 75% of the polyisobutylene output volume in 2013 was used for the production of tubes, tires and other pneumatic products.

As for global polyisobutylene production volume, it climbed to over 1.02 million tonnes in 2012. In the same year, Europe took lead in terms of polyisobutylene production, accounting for almost 31.7% of the global output. However, the North American region possesses the largest polyisobutylene capacities (over 36% of the world figure); but there was a number of production sites shortages in the end of 2012, therefore, the capacity utilization rate was lower than the European one.

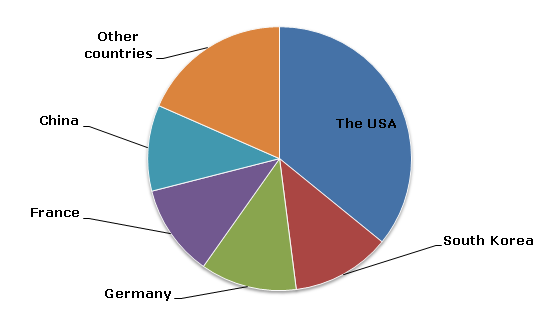

In 2012, the top five was made by such countries as the USA, South Korea, Germany, France and China. In the same year, their combined share of top five polyisobutylene producers was equivalent to 81.59%.

Polyisobutylene: structure of the global production by country, 2012

BASF, INEOS Oligomers, Daelim Industrial, Lubrizol Corporation, Infineum International, TPC Group, Chevron Oronite Company, Braskem SA, Jinzhou Jinex Lubricant Additive and Repsol YPF SA are among the dominant players in the worldwide polyisobutylene market.

In the years ahead, the world polyisobutylene production is poised to follow an upward trend, driven by the growing demand coupled with scheduled capacity additions. In 2017, the global polyisobutylene supply volume is anticipated to surpass the 1.2 million mark.

More information on the polyisobutylene market can be found in the research study “Polyisobutylene: 2014 World Market Outlook and Forecast up to 2018”.