Toluene diisocyanate (TDI) IS an intermediate in the production of polyurethane products, which account for 87% of global TDI consumption and are used in the downstream sectors of bedding (e.g. mattresses), furniture (e.g. upholstery) and the automotive industry (e.g. automotive seats). These sectors are highly susceptible to the influence of macroeconomic factors and prone to market volatility, thus making the global TDI market strongly dependent on economic situation. To this extent, the TDI market may act as a proxy index, showing the state of the world economy and marking its transitional stages of recession or recovery. Current economic state in Europe is characterized by uncertainty, though some signs of recovery are visible, which also affects the European TDI market. In anticipation of this recovery and in desire to combat this uncertainty, some major European players are poised for restructuring their current TDI production capacities.

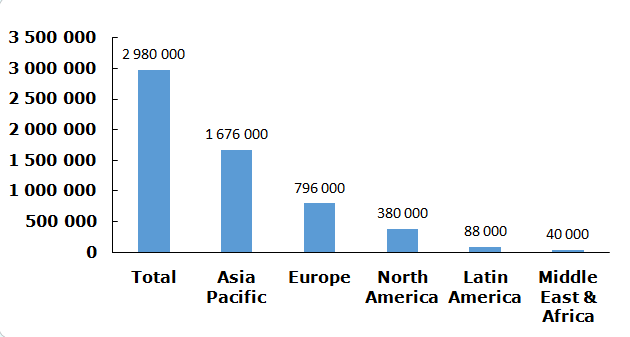

TDI: structure of the global production capacity (metric tonnes), by region (2013)

Thus, Bayer MaterialScience (BMS) and BASF, which are one of the major European TDI market players, have constructed new 300,000 mt/y TDI facilities in Dormagen and Ludwigshafen, Germany, respectively, but at the same time they have closed their existing facilities in Dormagen (owner: BMS, capacity: 105,000 mt/y) and Schwarzheide (owner: BASF, capacity: 80,000 mt/y). BMS also mulls a possibility of converting its TDI plant in Brunsbuettel into a facility manufacturing methylene diphenylene isocyanate (MDI).

Another major TDI market player, Hungarian isocyanates producer BorsodChem (manufacturing site: Kazincbarcika, Hungary), has also recently expanded its TDI capacity bringing it to 250,000 mt/y, though this expansion came predominantly as acquisition activity facilitated by a buyer, Wanhua Industrial Group (a global chemical and investment group from China).

The BorsodChem-Wanhua partnership is mirrored by the actions of another large European TDI manufacturer, Perstorp AB (manufacturing site in Europe: Pont-de-Claix, France), which decided to form a JV named Vencorex Holding with Thailand’s largest chemical producer PTT Global Chemical for the manufacturing and sales of polyurethane products, including TDI.

Thus, partnerships, on par with restructuring, become another tool which will assist large European TDI-manufacturing companies to cope with some bearish market sentiments and highly possible oversaturation of the EU market. Such ambivalence of strategic production plans is understandable. On the one hand, these players have to admit the consequences of weak demand from the downstream sectors, which may lead to oversupply and price drops, though they plan to mitigate these after-effects by correspondingly adjusting capacity utilization rates. On the other hand, they have to be ready for a highly plausible scenario of further recovering of the European economy. In addition, they are keen to export surplus amounts to Middle East, Africa and Eastern Europe.

More information on the TDI market can be found in the comprehensive research study “Toluene Diisocyanate (TDI): 2015 World Market Outlook and Forecast up to 2019” prepared by Merchant Research & Consulting.