Soda ash is an important industrial product used in the manufacture of glass, detergents and soaps, chemicals, as well as in metallurgy, environmental applications (e.g. acidity combating) and many other processes. The market for soda ash is rather stable, non-oligopolistic, mature, well-balanced and devoid of sharp price fluctuations. Despite relative stability, it is characterized by some regional imbalances, while the current market growth has a tendency towards slowing down.

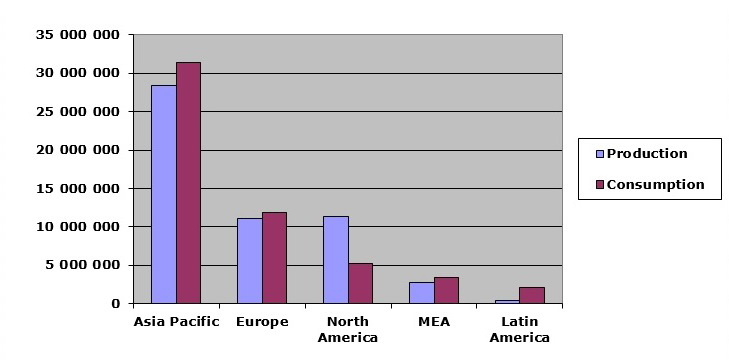

In general, the global soda ash market seems to have some prominent capacity excess. In 2013, soda ash capacity was over 65 mln. tonnes, while production and consumption featured figures of around 54-55 mln. tonnes each.

Soda Ash: structure of the global production and consumption by region, 2013 (tonnes)

With further capacity additions planned in Asia Pacific (China alone wants to expand the current soda ash capacity by almost 10 mln. tonnes by 2018), the Middle East and some other regions, this excessive capacity will lead to a number of closures, invigoration of M&A activities or switching to other products such as sodium bicarbonate. This is what actually happening now, especially in Europe (Austria, Germany, Portugal, Romania, UK), when numerous manufacturers (Solvay, Penrice, Tata Chemicals, or FMC Wyoming Corp, which announced the sales of its 3.75 mln. mt/y plant in Green River) have idled, closed or sold their soda ash production capacities, mainly synthetic soda ash plants popular in Europe.

Synthetic soda ash capacity prevails in Asia Pacific and Europe, while North America mostly sticks to natural soda ash production. In China, the rise of soda ash consumption for flat glass manufacturing (the glass industry remains concentrated in Asia) in the construction and automotive sectors may not be that significant as envisaged, which may exert downward pressure on soda ash market growth and market profitability in the region. This trend may become especially salient in the light of the current slowdown in the construction and automotive sectors in China and rising competition on behalf of US producers backed by falling domestic natural gas prices. This US competition rise may hamper Chinese export, which needs to grow in order to cope with excessive production volumes. The US market remains largely export-oriented with two-fold increase of production over consumption. To this extent, hugely undersupplied South American market seems highly prospective as a possible route of the US export. The European market for soda ash is struggling, marked by regional demand drops and high production costs, so the production volume in the European region decreased in 2013. Turkish soda ash producers may do well in future thanks to country’s advantageous geographical location and their benefits of ‘fast-follower’ status which prevents them from making many typical mistakes of mature companies.

In general, the future of the soda ash market may be viewed with relative optimism, especially for certain regions, subject to reasonable development strategies, regulatory policies, import tariff measures (e.g. protective tariffs on soda ash imports in India) and demand fluctuations.

More information on the soda ash market can be found in the in-demand research report “Soda Ash: 2015 World Market Outlook and Forecast up to 2019”.