Mercury is a fairly rare metal employed in a number of industrial applications, including the chlor-alkali industry (in the production of chlorine and sodium hystroxide), small-scale gold and silver mining, dental amalgams, batteries, electrical control/switches/relays, measuring equipment, compact fluorescent lamps (CFL), cosmetics, pesticides, and other uses. It is also a product of major global concern due to the significant risk associated with its detrimental influence on human health and the environment.

The market for mercury is characterized by several peculiar features. Firstly, global mercury commodity market is small in tonnage, value of sales and volume of trade operations, though the raw commodity mercury is extensively traded around the world, often via entangled, complex and uncontrolled routes (in general, mercury trade statistics is hard to follow and rely on). There are few key primary mercury producers on the market and their role is diminishing, but the importance of secondary suppliers and recyclers, who do not depend on mercury production, is rising as by-product and other secondary mercury recovery increases.

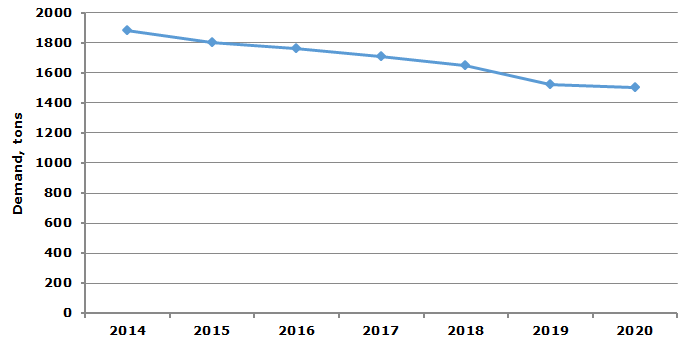

Secondly, thanks to the environmental and health-driven concerns, global demand for mercury is gradually ebbing (so are output, actual consumption and prices, with no prospects of a reversing trend), and the general market oversupply is vivid. There are multiple substitutes ready to be used instead of mercury: newer diaphragm and membrane cell technologies are arriving to change the old-fashioned mercury-cell process; lithium, nickel-cadmium, zinc-air and indium batteries are replacing mercury-based batteries; digital thermometers are pushing away mercury-centred measuring products; gallium alloys are providing nontoxic substitutes for mercury in a wide variety of applications.

According to the European Commission, the projected decrease (by the order of magnitude) in global mercury demand will be the largest in the following mercury use categories (within the period from 2000 to 2020): batteries (from 1081 tonnes in 2000 to 100 tonnes in 2020, which is characterised as steep decline by the EC), chlor-alkali industry (from 797 tonnes to 280 tonnes, branded as significant decline), measuring and control (from 166 tonnes to 100 tonnes; general decline), electrical control and switching (from 154 tonnes to 100 tonnes, general decline), and dental amalgam (from 272 tonnes to 250 tonnes; gentle decline). Less predictable situation is observed in the category of small-scale gold and silver mining. While the general drop will happen (from 650 tonnes to 400 tonnes), the increases and robust use may occur in the developing countries, where this hazardous process may be buoyed by the gold price spikes. The only rise in the mercury demand, at least in the foreseeable future, is expected in the segment of lighting.

Mercury market demand forecast up to 2020, tonnes

Despite the general consensus to phase-out mercury cell chloralkali plants and multiple anti-mercury regulations and laws, like the Minamata Convention on Mercury, some mercury uses will be left intact: this primarily refers to the applications with no current mercury-free alternatives, like special vaccines, large measuring devices or some product used in esoteric, traditional or religious applications such as spiritual cleansing rituals. However, such applications are only marginal and they could not change the economic prospects of mercury, which may be characterised as non-existent.

Mercury becomes part of a problem in all stages of its circulation (mining, production, storage, application and sales), rather than part of a solution. Even the 2020 phase-out activities for Western European mercury cell chloralkali plants arouse concerns over possible major release of mercury into the international market, which gave birth to an idea of selling chlor-alkali industry’s residual mercury to an established mercury producer so as to displace new production of the equivalent quantity of virgin mercury.

With so many readily available substitutes, extra hassle and exposure risks, mercury has no economically viable future, unless some new risk-free and high tech applications will be found, for example, for space exploration programmes.

More information on the mercury market can be found in the insightful research report “Mercury: 2015 World Market Review and Forecast”.