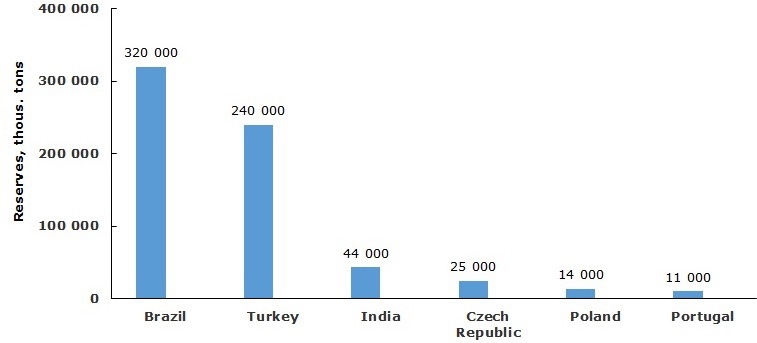

Feldspar is an important industrial mineral with resources big enough to meet existing and expected demand. The largest feldspar reserves are concentrated in Brazil, Turkey, India, Czech Republic, Poland and Portugal, while the main feldspar producers are Turkey, Italy, China and Thailand. The major end uses of feldspar include glass containers, ceramics (incl. tiles and sanitaryware), fillers, and glass fibre insulation used in commercial, industrial and residential applications, thus linking feldspar market dynamics to the behaviour of such varied and versatile industries as food, beverages, construction/renovation/decoration or homeware production.

Feldspar reserves worldwide as estimated in 2013, distributed by major countries, thousand tons

The global feldspar market is fairly well-balanced, bullish, and prospective, with geographically uneven spread of resources/production facilities and with relatively large degree of monopolization on the level of many regional markets.

The demand for feldspar in each specific consumption segment has geographic, economic, environmental, social and other dimensions. The factors behind these dimensions often act in opposite directions with possible attenuating or strengthening effect on demand growth. For example, the boost in the construction industry in the post-Soviet times has lead to the increase in tile consumption in many Central/Eastern European and CIS countries, while the opening of their markets facilitated feldspar exports to other European countries, thus raising competition on the feldspar market. Feldspar use in the tile sector in the United States and Western Europe will encounter with the increase in imports and the slow pace of housing market rebound after the economic recession.

The competition between glass and plastic container segments may also be instrumental in shaping prospects for the future development of the feldspar market, shifting some extra demand for feldspar within the container segment to the Asia Pacific region, Central and Eastern Europe, and parts of South America. The same trend may be true for the segment of glass fibre insulation where the greatest growth in feldspar consumption will occur in Eastern Europe, the CIS and some parts of Asia. However, the economic slowdown in China, which affects the local construction industry, may stymie the development of feldspar demand in the construction sector in China.

Fairly modest growth in the tableware market in many developed countries may also adversely affect feldspar consumption in these countries. Glassmaking will remain the main application area for feldspar, with feldspar consumption gradually shifting from ceramics toward glass markets. Sanitaryware production continued to expand in China, Mexico, the Middle East, South America, and South East Asia. Overall, the global feldspar market is expected to grow by 2.7% per year in the coming years, driven primarily by demand from Eastern Europe, South America and Southeast Asia (mainly India and China).

More information on the feldspar market is available in the in-demand report “Feldspar: 2015 World Market Review and Forecast”.