Global vanadium market is driven by several factors. As vanadium’s main application area is in the steel industry, in a very simplistic way of looking at things, there are two main variables that are really critical for influencing the vanadium market. These variables comprise the general steel output dynamics and the intensity of using vanadium in steel products.

According to the Metal Bulletin 28th International Ferroalloys Conference, the latter parameter is actually the specific vanadium consumption rate defined in kilograms of V used per metric ton of steel produced, or KgV/MT steel. Vanadium content in steel varies according to type and grade, and differs by producer and region (source: Roskill). In relative terms, it could be below the 0.5% level in high strength low-alloy (HSLA) steels or as much as 20% in high alloy steels (source: TTP Squared, Inc & Metal Bulletin). Regionally, average vanadium content in kg per tonne of steel also varies significantly – from 0.02 kg/ton in China to 0.07 kg/ton in Europe and 0.08 kg/ton in North America (Source: Largo Resources).

Both these variables, in turn, are affected by different factors themselves. For instance, the content of vanadium in steel may be predicated on the specific regulations, analogous to those imposed by the Chinese government, which decided to promote high strength rebar use in construction and to gradually eliminate the use of lower strength bars by 2015, thus leading to the increased use of vanadium in steel fixtures. However, this increase may be largely offset by the slowdown of the Chinese economy, which is detrimental for the whole construction and civil engineering sector.

Other important factor influencing the vanadium market may include the proliferation of different products containing vanadium, like vanadium redox flow batteries (VRB), catalysts, ceramic pigments, special glasses, etc. Macroeconomic situation is vital too as it directly affects construction, infrastructure projects, aviation, car-making and other industries, and so is availability of substitutes.

Despite interchangeability with molybdenum, niobium, titanium or tungsten as alloying elements in steel, vanadium has no acceptable alternatives in aerospace titanium alloys, but this consumption area is not decisive. Quite expectedly, vanadium market behaviour involves a lot of interrelated geographic, corporate and economic specifics. For example, weaker Russian rouble and curtailed domestic market may boost the Russian steel and vanadium exports in the short-term perspective.

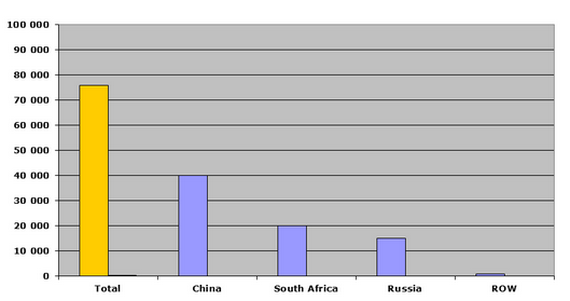

However, imposed sanctions, European/U.S. protectionism and rivalry with China (in 2014, Russia exported 25 mln tonnes of steel against 80-90 mln tonnes of Chinese steel exports) may act as strong barriers in the long-term perspective. Russia is a large regional player on the vanadium market, though its vanadium export volumes are not particularly large. For instance, in 2013, Russia exported about 1 416 tonnes of ferrovanadium against 6 074 tonnes of Chinese ferrovanadium exports.

Vanadium: structure of the global production by country, 2013

The current world vanadium market is marked by oversupply and price volatility. The construction boost of the previous years, which spurred many companies, especially in China, to increase steel production and related vanadium capacity was the reason of the oversupply when the state of the world economy has changed and now fluctuates between global crisis and regional uncertainties. However, despite this the vanadium consumption will definitely grow at a steady pace of 5.1% in the coming years, buoyed by vanadium supreme properties, improving construction standards and the rise in vanadium high-tech applications.

More information on the vanadium market can be found in the insightful market research report “Vanadium: 2015 World Market Review and Forecast”.