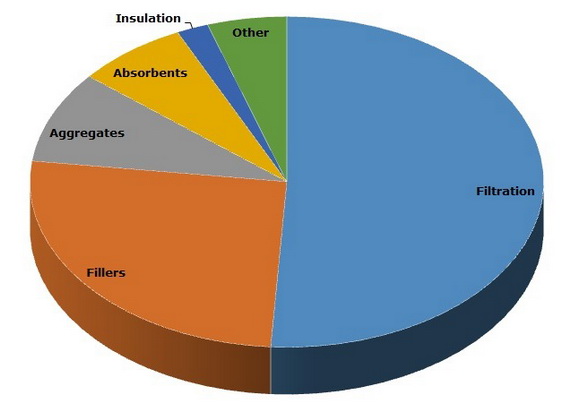

Diatomite, also known as kieselgur, is the naturally occurring fossilized siliceous mineral used in filter aids (they currently account for over a half of diatomite consumption worldwide), fillers (over a quarter of world diatomite consumption), absorbents for industrial spills and pet litter, insulation products, water treatment media, crop protection chemicals, silica additives, paints, mild toothpaste abrasives, facial scrubs, fungicides, insecticides, to name just a few.

Diatomite: main end-uses

It is mined by open-pit quarrying techniques that are relatively inexpensive thanks to near-surface occurrence of diatomite sedimentary rocks, but heavy earthmoving equipment is required for such operations. Further processing of high-grade diatomite is very energy intensive. In general, 60% of all diatomite-manufacturing costs are associated with its processing, which usually involves a series of crushing, milling, drying, size reduction, agglomeration, air separation, calcining and flux-calcination operations. For instance, calcined and flux-calcined diatomite grades, used in filter aids, multifunctional fillers and aggregates, demand a production temperature in excess of 900°C in rotary kilns.

Apart from energy intensity, another serious issue of calcined diatomite processing and diatomite waste disposal, especially in the filler and absorbent markets, is related to health and safety concerns associated with free crystalline silica content, which requires the installation of relevant worker protection systems and other efforts. This is a main threat for diatomite market.

Diatomite usually is processed near its mines to reduce the cost of expensive hauling (diatomite can absorb liquid three times the weight of its own), which also determines the development of regional diatomite markets on par with availability of resources and other economic factors.

However, diatomite will remain quite a competitive mineral, largely owing to its use as a filtration medium, where its demand will be strong, especially in the brewery segment. Diatomite use in the filtration sector will be supported by new high-tech application areas like filtration of human blood plasma and other biotechnical uses. Diatomite substitutes will hardly be able to compete with it. However, demand fluctuations, analogous to those caused by the economic recession of 2008-2009, could be detrimental for the diatomite market and its players. For instance, in early 2009, Imerys Minerals Ltd., the largest diatomite producer in the world, announced possible temporary closures of all U.S. filtration mineral operations.

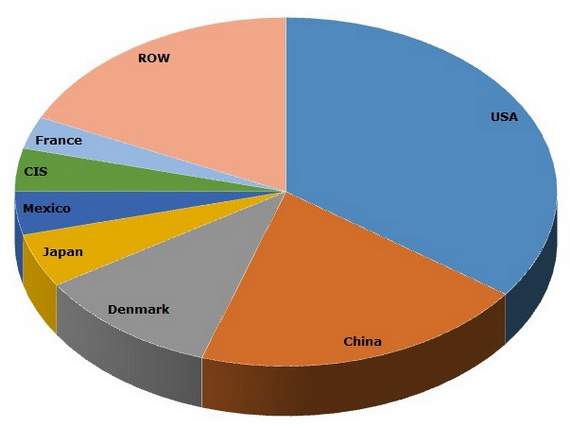

Commercial deposits of high-purity diatomite are limited, though world reserves of crude diatomite are quite abundant and exceed current production levels by many times. In 2008, diatomite reserves were estimated to be 1 billion metric tons, which was about 500 times larger than estimated world production of about 2.2 million metric tons produced that year. This excludes any diatomite deficit in the foreseeable future. Currently, the USA is the world’s largest diatomite producer, accounting for about 35% of global total (with the world’s largest producing deposit near Lompoc, CA).

Diatomite: structure of the global production by country

Other major producers include China, Japan, Denmark, Mexico, France, Russia, Germany, Spain, Peru and Chile. In 2004, Iceland closed its main diatomite plant at Lake Mývatn for environmental and marketing reasons. The USA will remain the major producer of diatomite, though it is rivaled by China. Diatomite projects are announced in various countries.

More information on diatomite market can be found in the insightful research report “Diatomite: 2015 World Market Review and Forecast”.