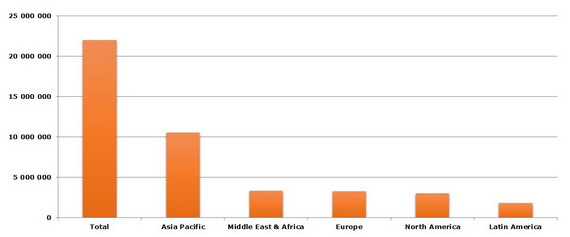

In 2014 global polyethylene terephthalate (PET) production worldwide totaled 21.9 million tones. The average PET output growth rate was 6.4% globally, though it showed significant interregional variance. Average capacity utilization rate across the globe was around 75% and demonstrate a constant decline.

Polyethylene Terephthalate: structure of the global production by region, 2014

In the last few years worldwide PET capacity increased dramatically, which caused global oversupply. To achieve a supply and demand balance, many companies have to lower operating rates. Another viable strategy to safeguard competitive advantage is vertical integration of new and existing PET production facilities. Vertically integrated PET-producing companies are much better placed than other polyethylene terephthalate manufacturers and will probably form a trend for the development of the PET market. Operation in multiple PET market segments (PTA, fibers and yarns, processing, etc) will allow serving diverse markets, including carbonated soft drink (CSD), water, beer, juice, food, alcoholic beverages, pharmaceuticals, household, APET sheet, film extrusion, textile and fabric, home insulation, etc. Vertical integration will guarantee availability of abundant and closely located resources, but must be joined by proper management, effective technologies, sound financing schemes and comprehensive strategic marketing plans. For instance, Oman International Petrochemical Industries Company (OMPET) plans to build a $600mln-worth integrated PTA/PET complex at Sohar Port by 2018. A synergy of an available petrochemical cluster (Orpic’s aromatics plant), an industrial port, state support (OMPET is a subsidiary of government-owned Oman Oil Company), ample investment (investment company Takamul owns 20% in OMPET), participation of large players with modern know-hows (LG International) and vicinity to all prospective markets (Middle East role as an excellent trade hub) makes the project a win-win situation from the start and a clear illustration of the above-mentioned competitive advantage of vertically integrated companies operating on the PET market. A similar win-win strategy to PET manufacturing, along with other approaches (like acquisition of acting companies), will be exhibited by various companies in other projects. For example, one can list INDORAMA (an integrated PTA/PET complex in India to be commissioned in early 2016), “ETHANY” project in Kabardino-Balkaria, Russia (PET capacity will grow through 2017), and M&G Chemicals (plans to build the world’s largest vertically integrated single-line PTA/PET plant in Corpus Christi), to name only a few.

More information on the PET market can be found in insightful research report “Polyethylene Terephthalate (PET) 2015 World Market Outlook and Forecast up to 2019”.