Acrylic Acid: 2024 World Market Outlook and Forecast up to 2033

ACRYLIC ACID MARKET TRENDS, DEVELOPMENTS AND PROSPECTS:

- major downstream sector for acrylic acid is the personal care products industry; another significant application area is surfactants & surface coatings production

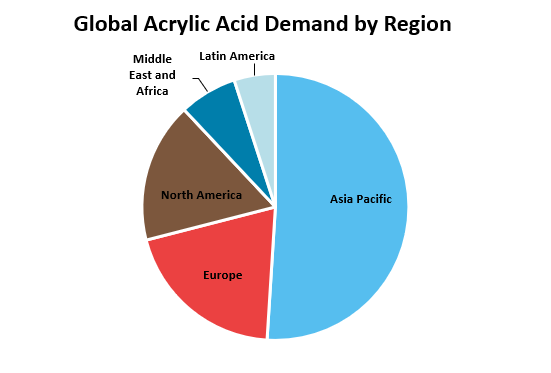

- Asia Pacific continues to be the world largest acrylic acid producer with more than half share in global total as well as the biggest consumer

- China and India consume considerable amount of acrylic acid for the production of super absorbent polymers

- global acetic acid market will grow supported, first of all, by the demand from personal care products industry

- Asia Pacific will continue to be the main consuming region, demand in North America and Europe will also grow at slower rates

- for quite a long period of time there have been attempts to produce bio-based acrylic acid; one of the successful stories is Procter & Gamble (P&G), which in early 2020 granted Cargill an exclusive license for its proprietary lactic-to-acrylic-acid technology

- Cargill intends to further develop and commercialize the lactic-to-acrylic-acid technology; however, it will take several more years before the process is put on stream

Acrylic Acid 2024 World Market Outlook and Forecast up to 2033 grants access to the unique data on the examined market. Having used a large variety of primary and secondary sources, our research team combined, canvassed and presented all available information on product in an all-encompassing research report clearly and coherently.

The market report not only contains a detailed market overview but also offers a rich collection of tables and figures, thus providing an up-close look at country, regional and world markets for product. It also includes a ten-year forecast showing how product market is set to develop.

Report Scope

Geographically the market report covers:

- World

- Regions

- Countries

Timeframe of the market report:

- Present situation

- Historical background

- Ten-year forecast

Global market analysis includes:

- Capacity

- Production and consumption

- Trade statistics

- Prices

- Projects

- Feedstock

- End-use sector

A region/country market overview comprises:

- Capacity

- Supply/demand

- Prices

- Export and import

- Manufacturers and suppliers

Reasons to Buy

- The report provides the reader with unrivalled knowledge of the acrylic acid market

- Unique examination of the market in different geographical settings and analysis of global and regional trends influencing the industry assist in the effective business planning

- You will push up you company’s sales and deepen foothold in the industry by gaining a full understanding of the market

- Thorough assessment of the competitive environment and in-depth overview of market participants help to understand who stands where on the market and identify prospective business partners

- Comprehensive acrylic acid market forecast will improve the decision-making process

*Please note that "Acrylic Acid: 2024 World Market Outlook and Forecast up to 2033" is a half ready publication and contents are subject to changes and additions. We have all data necessary for report preparation but it needs to be retrieved from our databases, organized in a report, updated with the latest information and thus the complete study will be presented. This process takes 5-7 business days after the order is placed. Thus, our clients always obtain a revised and updated version of each report. Please note that we do not charge for an updating procedure.

DISCLAIMER

RESEARCH METHODOLOGY

1. INTRODUCTION: ACRYLIC ACID PROPERTIES AND USES

2. ACRYLIC ACID MANUFACTURING PROCESSES

3. ACRYLIC ACID WORLD MARKET

3.1. World acrylic acid capacity

– Capacity broken down by region

– Capacity divided by country

– Manufacturers and their capacity by plant

3.2. World acrylic acid production

– Global output dynamics

– Production by region

– Production by country

3.3. Acrylic acid consumption

– World consumption dynamics

– Consumption trends in Europe

– Consumption trends in Asia Pacific

– Consumption trends in North America

– Consumption trends in Latin America

– Consumption trends in Middle East and Africa

3.4. Acrylic acid global trade

– World trade dynamics

– Export and import flows in regions

3.5. Acrylic acid prices in the world market

4. ACRYLIC ACID REGIONAL MARKETS ANALYSIS

Each country section comprises the following parts:

– Total installed capacity in country

– Production in country

– Manufacturers in country

– Consumption of in country

– Export and import in country

– Prices in country

4.1. Acrylic acid European market analysis

– Countries covered:

– Belgium

– Czech Republic

– France

– Germany

– Russia

4.2. Acrylic acid Asia Pacific market analysis

– Countries included:

– China

– Indonesia

– Japan

– Malaysia

– Singapore

– South Korea

4.3. Acrylic acid North American market analysis

Countries under consideration:

– USA

4.4. Acrylic acid Latin American market analysis

Countries overviewed:

– Mexico

4.5. Acrylic acid African market analysis

Countries examined:

– South Africa

5. ACRYLIC ACID MARKET FORECAST TO 2033

5.1. Acrylic acid capacity and production forecast up to 2033

– Global production forecast

– On-going projects

5.2. Acrylic acid consumption forecast up to 2033

– World market projections

– Consumption forecast in Europe

– Consumption forecast in Asia Pacific

– Consumption forecast in North America

– Consumption forecast in Latin America

– Consumption forecast in Middle East and Africa

5.3. Acrylic acid market prices forecast up to 2033

6. KEY COMPANIES IN THE ACRYLIC ACID MARKET WORLDWIDE

Each company analysis covers (depending on data availability):

– Company overview

– Business segmentation

– Company SWOT analysis

– Acrylic acid production technology, specification

– Acrylic acid production capacity and plants, share in the global industry

– Recent company activities in acrylic acid market

7. ACRYLIC ACID FEEDSTOCK MARKET

8. ACRYLIC ACID END-USE SECTOR

8.1. Consumption by application

8.2. Downstream markets review and forecast

Global acrylic acid capacity by region in 2023

Acrylic acid capacity by country in 2023

Global acrylic acid production trends in 2018-2023

Global acrylic acid production broken down by region, 2023

World acrylic acid production by country in 2023

World acrylic acid consumption trends in 2018-2023

Global acrylic acid consumption broken down by region, 2023

Consumption trends in Europe in 2018-2023

Consumption trends in Asia Pacific in 2018-2023

Consumption trends in North America in 2018-2023

Acrylic acid global trade in recent years

Europe acrylic acid prices dynamics

Asia acrylic acid prices dynamics

North America acrylic acid prices dynamics

Total acrylic acid capacity in Belgium, 2023

Belgium: production in 2018-2023

Belgium: consumption in 2018-2023

Trade operations in Belgium in recent years

Acrylic acid prices in Belgium in recent years

Total acrylic acid capacity in Czech Republic, 2023

Czech Republic: production in 2018-2023

Czech Republic: consumption in 2018-2023

Trade operations in Czech Republic in recent years

Prices in Czech Republic in recent years

Total acrylic acid capacity in France, 2023

France: production in 2018-2023

France: consumption in 2018-2023

Trade operations in France in recent years

Prices in France in recent years

Total acrylic acid capacity in Germany, 2023

Germany: production in 2018-2023

Germany: consumption in 2018-2023

Trade operations in Germany in recent years

Acrylic acid prices in Germany in recent years

Total acrylic acid capacity in Russia, 2023

Russia: production in 2018-2023

Trade operations in Russia in recent years

Prices in Russia in recent years

Total acrylic acid capacity in China, 2023

China: production in 2018-2023

China: consumption in 2018-2023

Trade operations in China in recent years

Prices in China in recent years

Total acrylic acid capacity in Indonesia, 2023

Indonesia: production in 2018-2023

Indonesia: consumption in 2018-2023

Trade operations in Indonesia in recent years

Acrylic acid prices in Indonesia in recent years

Total acrylic acid capacity in Japan, 2023

Japan: production in 2018-2023

Japan: consumption in 2018-2023

Trade operations in Japan in recent years

Acrylic acid prices in Japan in recent years

Total acrylic acid capacity in Malaysia, 2023

Malaysia: production in 2018-2023

Malaysia: consumption in 2018-2023

Trade operations in Malaysia in recent years

Acrylic acid prices in Malaysia in recent years

Total acrylic acid capacity in Singapore, 2023

Singapore: production in 2018-2023

Singapore: consumption in 2018-2023

Trade operations in Singapore in recent years

Acrylic acid prices in Singapore in recent years

Total acrylic acid capacity in South Korea, 2023

South Korea: production in 2018-2023

South Korea: consumption in 2018-2023

Trade operations in South Korea in recent years

Acrylic acid prices in South Korea in recent years

Total acrylic acid capacity in USA, 2023

USA: production in 2018-2023

USA: consumption in 2018-2023

Trade operations in USA in recent years

Acrylic acid prices in USA in recent years

Total acrylic acid capacity in Mexico, 2023

Mexico: production in 2018-2023

Mexico: consumption in 2018-2023

Trade operations in Mexico in recent years

Acrylic acid prices in Mexico in recent years

Total acrylic acid capacity in South Africa, 2023

South Africa: production in 2018-2023

South Africa: consumption in 2018-2023

Trade operations in South Africa in recent years

Acrylic acid prices in South Africa in recent years

Global acrylic acid production forecast up to 2033

Planned acrylic acid capacity introductions

Global acrylic acid consumption forecast up to 2033

Europe: consumption forecast up to 2033

Asia Pacific: consumption forecast up to 2033

North America: consumption forecast up to 2033

Europe: acrylic acid prices forecast up to 2033

Asia: prices forecast up to 2033

North America: prices forecast up to 2033

Key companies acrylic acid capacities in 2023

Acrylic acid capacity broken down by region, 2023

Countries capacity shares in world total, 2023

Major acrylic acid producers in the world, 2023

Structure of global consumption, 2023

Europe acrylic acid prices dynamics

Asia acrylic acid prices dynamics

North America acrylic acid prices dynamics

Supply/demand balance in Belgium, 2018-2023

Trade balance of acrylic acid in Belgium in recent years

Supply/demand balance in Czech Republic, 2018-2023

Trade balance of acrylic acid in Czech Republic in recent years

Supply/demand balance in France, 2018-2023

Trade balance of acrylic acid in France in recent years

Supply/demand balance in Germany, 2018-2023

Trade balance of acrylic acid in Germany in recent years

Supply/demand balance in Russia, 2018-2023

Trade balance of acrylic acid in Russia in recent years

Supply/demand balance in China, 2018-2023

Trade balance of acrylic acid in China in recent years

Supply/demand balance in Indonesia, 2018-2023

Trade balance of acrylic acid in Indonesia in recent years

Supply/demand balance in Japan, 2018-2023

Trade balance of acrylic acid in Japan in recent years

Supply/demand balance in Malaysia, 2018-2023

Trade balance of acrylic acid in Malaysia in recent years

Supply/demand balance in Singapore, 2018-2023

Trade balance of acrylic acid in Singapore in recent years

Supply/demand balance in South Korea, 2018-2023

Trade balance of acrylic acid in South Korea in recent years

Supply/demand balance in USA, 2018-2023

Trade balance of acrylic acid in USA in recent years

Supply/demand balance in Mexico, 2018-2023

Trade balance of acrylic acid in Mexico in recent years

Supply/demand balance in South Africa, 2018-2023

Trade balance of acrylic acid in South Africa in recent years

Key companies plants shares in companies’ total, 2023

Key companies shares in the global market, 2023

Detailed analysis of acrylic acid market in a country is available covering data on capacity (by plant), production, consumption, trade, prices and market forecast.

Please select a country from the list below (if you do not find a market report you would be interested in, please contact a member of our team - [email protected]).

Ask a question or Order by email

More Reports

| Title | Date | Pages | Price |

|---|---|---|---|

| Apr, 2024 | 178 | US$ 4,500.00 | |

| Apr, 2024 | 97 | US$ 4,500.00 | |

| Apr, 2024 | 328 | US$ 4,500.00 |

Our Partners & Customers