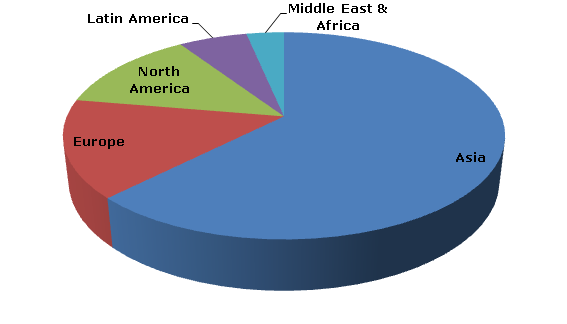

In 2012, global annual production capacity of carbon black climbed to around 14.5 million tonnes. In the same year, Asia called for over 60% share of the total сapacity of the material, which is equal to approximately 9 million tonnes. China ranked the first in the region as well as in the world in terms of carbon black production capacity, accounting for just over 65% of the Asian region’s capacity, and for more than 41% of the global capacity. As of 2012, China, the US, India, Russia and Japan were the top five countries in terms of carbon black production capacity worldwide, with a combined share of almost 70%.

Carbon black capacity broken down by region, 2012

During 2002-2007, the world carbon black market experienced stable growth, supported by the embedded demand from various end-use sectors of. However, due to the worldwide recession, both the production of, and the demand for carbon black declined in 2008. Nevertheless, in 2010 the situation in the market improved, and between 2010 and 2012 the market followed an upward trend. Last year, the global production of carbon black exceeded 11 million tonnes.

As of 2012, Asia-Pacific took the lead in the world carbon black market in terms of production, accounting for almost 62% share (over 6.8 million tonnes) of all carbon black produced globally. It was followed by Europe and North America. China, the US, India, Russia and Japan were the top five carbon black manufacturing countries.

Carbon black production broken down by country, 2012

Aditya Birla Group, Cabot Corp, Orion Engineered Carbons, Jiangxi Black Cat Carbon Black, China Synthetic Rubber Corp, Sid Richardson Carbon Co, Phillips Carbon Black Ltd – (PCBL), OMSK CARBON GROUP, Shandong Huadong Rubber Materials Co., Bridgestone Corp., JSC “Yaroslavskiy Tekhnicheskiy Uglerod” and Jiangxi Lanjing Carbon Black are amid the entrenched players in the world carbon black marketplace.

Asia-Pacific is the largest consumer of carbon black. In 2012, the product consumption volume in the region went beyond 6.49 million tonnes. In the same year, the rubber industry, by far biggest end-use market for carbon black, consumed over 89% of the globe’s product supply.

The world carbon black market is poised to register sustainable growth in the upcoming years. The overall supply is forecast to surpass the 12.9 million tonnes mark in 2015, driven by the constantly increasing demand for carbon black from various end-use industries, as well as scheduled capacity additions worldwide. APAC is expected to maintain its leadership in the global carbon black market in the oncoming years.

More information on the carbon black market can be found in the report “Carbon Black (BC): 2013 World Market Outlook and Forecast up to 2017”.