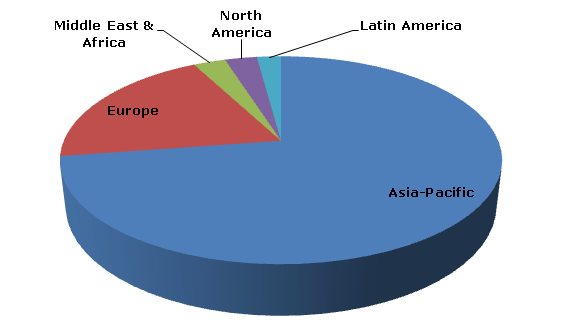

In 2013, the world capacity of melamine output exceeded 2.84 million tonnes. In the same year, the Asian-Pacific region was an unrivalled leader in terms of melamine production capacity; the region’s share in the world’s total capacity was equivalent to 72.63%. The largest contribution to the region’s capacity was made by China. The second position was occupied by Europe with a 19.65% share. Other regions held insignificant shares (just under 3%) in the world melamine capacity.

Melamine: structure of the global production capacity by region, 2013

During 2009-2010, the world melamine market was characterized by a tough supply owing to the unfavourable economic conditions worldwide and, therefore, numerous closing-downs of melamine plants.

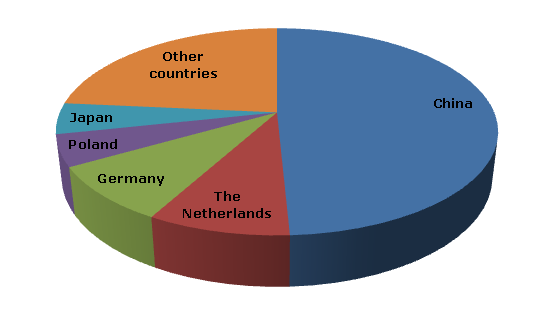

However, the situation in the melamine market is steadily improving. From 2011 to 2013, the global melamine market followed a stable upward trend. As of 2013, the world melamine production volume surpassed the 1.6 million tonnes mark. China, the Netherlands, Germany, Poland and Japan were the top five melamine manufacturing countries in 2013; their combined share in the world melamine production was almost 76.5%.

Melamine: structure of the global production by country, 2013

OCI Melamine, Haohua Junhua Group, Shandong Liaocheng Luxi Chemical, Borealis, Sichuan Golden Elephant Chemical, Jinan Xiangrui Chemical, Zaklady Azotowe Pulawy SA, Sichuan Chemical Holdings, Shandong Shuntian Melamine, Cornerstone Chemical Company, BASF AG and Qatar Melamine are among the top players active in the global melamine market.

During the recession years, the demand for melamine in Europe experienced a remarkable decline, whilst it was not so dramatically affected in the countries of the Asian region. In 2013, the world melamine demand managed to reach the pre-crisis level and stood at around 1.6 million tonnes.

At present, the largest contribution to the growth of the global melamine demand is made by the developing countries. The APAC region accounts for nearly 55% of the world’s total demand. China and the countries of the Middle East region are the biggest exporters of melamine, while the US and European countries keep top positions in melamine import. The laminates and wood adhesives industries are the major melamine end-use sectors.

The global melamine production is poised to post stable growth in the years ahead, driven by the constantly rising demand, improving economic situation across the globe and also scheduled capacity addition projects. In 2019, the world melamine production is likely to exceed 2.1 million tonnes.

More information on the melamine market can be found in the in-demand research report “Melamine 2014 World Market Outlook and Forecast up to 2018”.