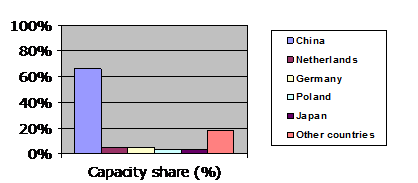

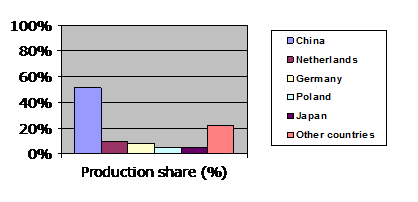

China remains one of the biggest markets for melamine in terms of production capacity (over 66%, Fig.1), output (51%, Fig.2) and consumption (38%). China’s dominant position on the global melamine market is likely to persevere and provide most of the growth. As compared to countries in Europe and North America, the Chinese market for melamine is more stable and less susceptible to fluctuations, though recent slowdown of the Chinese economy may affect the local wood-based panel industry with its adhesive resins and laminates sectors, which are considered the largest outlet for melamine application (jointly 75% of melamine consumption globally).

The fact that the state of the Chinese economy, strongly linked to the state of melamine-consuming sectors, will render the major impact on the national melamine market is substantiated by the current situation when the bulk of locally produced melamine is consumed within the country. However, China is also a large melamine exporter which helps the country to increase production volumes at a rate higher than local consumption growth rate. Thus, the current Chinese melamine market demonstrates a steady output growth in comparison with 2013, while melamine consumption on the Chinese market grows at a much slower rate. Nevertheless, it is highly possible that melamine output will decelerate in the nearest future.

Fig.1. Capacity shares of major melamine-manufacturing countries in the world, 2014

Fig.2. Output shares of major melamine-manufacturing countries in the world, 2014

The large melamine production facilities in China are operated by both national and international manufacturers, but local manufacturers dominate the national market. For example, OCI Melamine owns large capacities in China (in Pinglu & Jishan). Main local melamine-manufacturing companies are as follows (location of melamine-manufacturing facilities and capacity shares of the national total are provided for 2014): Haohua Junhua Group Co (Zhumadian; the largest melamine manufacturer in China with 8.44% share of the national total), Shandong Liaocheng Luxi Chemical Co. (Liaocheng, the second largest manufacturer of melamine in China, 8.18%), Sichuan Golden Elephant Chemical Co. (Xinjiang, 6.14%), Jinan Xiangrui Chemical Co. (Jinan, 5.12%), Shandong Liaherd Chemical Industry Co. (Zibo & Xintai, 4.09%), etc. The Chinese melamine market is demonopolized and shared between a various, fairly large producers. The arrival of new players to the market is plausible, though maybe largely impeded due to sharp competition.

More information on the melamine market and key market players can be found in the in-demand research study “Melamine: 2015 World Market Outlook and Forecast up to 2019”.