The world methanol market has been undergoing rapid transformation which may take different scenarios. The first scenario is optimistic when numerous experts and market players eagerly portray the bright future for this chemical product.

It goes without saying, that methanol is one of the most important chemical commodities vital for many industries, economy branches and sustainable development in general, with versatile and prospective outlets including power generation, chemical industry, and transportation. In a relatively short period, methanol managed to pass the route from a gas monetization option to an independent chemical commodity in its own right.

The optimistic scenario is backed by various factors. Methanol offers environmental benefits; it is an excellent transportation fuel, often viewed as a fuel source for the future; it stipulates lower energy costs and acts as a money-saving product for consumers as compared to gasoline or ethanol. It has numerous economic strengths being a value-added commodity that is able to decrease a price gap between coal/gas and other petroleum products thanks to its capacity to use various types of feedstock. It is also technologically attractive as it does not require drastic changes in engine architecture. Its versatility and potential for new applications may easily boost its demand in future. Recent drop in natural gas prices and shale gas advances may only brighten this optimistic picture. Unsurprisingly, all these benefits result in its support rendered by regulatory authorities in many countries via various legislation acts and relevant programs.

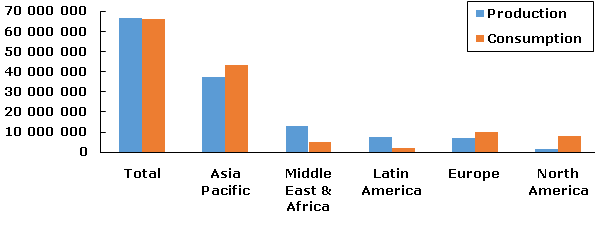

However, another, less optimistic, scenario is also possible, at least in long-term future. Despite its robust growth, the methanol market suffers from a number of incongruities. Currently, global methanol production and consumption are in the state of equilibrium, though regionally it is often not the case, and such equilibrium can be easily violated.

Methanol: structure of the global production and consumption, 2013, (tonnes)

The methanol market is characterized by significant price fluctuations and often by inadequate profit margins, which is driven by a roster of factors, and this unbalanced situation has all potential to turn into a lasting trend. For example, recent looming deal with Iran, which may ease off sanctions and unfreeze Iranian methanol exports, will affect methanol prices.

The opposite turn of the events is also highly possible. Thus, the global methanol market is vulnerable to multiple influences. Low capacity utilization rates (70% globally and 60% in China, in 2013), which have been characteristic of the global methanol market for a long period of time, are also not good signs of the bright future.

It is interesting that, to a great extent, the optimistic scenario for methanol hinges on the beliefs that methanol applications, both old and new, especially in the field of energy and transportation, will drive demand for methanol. Though this may be totally true in short or mid-term future, there are no grounds to believe that this will definitely happen in distant future. Possible technological innovations are very hard to predict, and it is highly plausible that energy and transportation development may skip methanol stage and rely on other components.

More information on the methanol market can be found in the insightful research study “Methanol: 2015 World Market Outlook and Forecast up to 2019”.