Selenium is a relatively rare non-metallic element which finds uses in multiple high-tech industrial products, including photovoltaic cells, AC-to-DC electrical converters, specialized low-conductance sheet glass, human dietary supplements, steel alloys, catalysts, etc. However, as a component of many high-tech products, it has to compete against a number of substitute products. For instance, high purity silicon is now being used in the production of rectifiers. Other alternatives to selenium are as follows: cerium oxide for glass coloration; amorphous silicon and cadmium telluride in photovoltaics; sulfur dioxide in metallurgy; tellurium in pigments and rubber; bismuth, lead, and tellurium in free-machining alloys, to name only a few. In the case of a high-tech product it is not sufficient nowadays to just compare its technical specs to available alternatives, as it is vital to fully understand what can drive a potential customer to choose this high-tech product instead of existing alternatives. The same stands true for the components of high-tech products. In case of selenium, its prospects in a number of applications are undisputable, whereas its future with respect to other application areas seems quite vague.

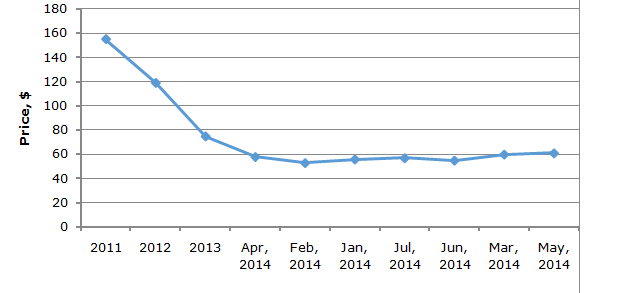

Selenium is an essential trace element for humans and other animals so its inclusion into the content of livestock supplements and fertilizers for selenium-poor soils is indispensible. Global demand for selenium demonstrated by the glass-manufacturing industry might also feel quite safe, as there are few substitutes for this application. Use-specific factors will also interplay with regional aspects. Thus, for example, the demand for selenium in China, the world’s leading consumer of selenium, is expected to decline due to the loss of interest in selenium from the electrolytic manganese metal industry. The same situation is quite possible for the use of selenium in copper indium gallium diselenide (CIGS) solar cells, where it encounters with competition from amorphous silicon and cadmium telluride. The ensuing uncertainty negatively affects selenium prices which dropped from over $150/kg in 2011 to below $60/kg in 2014.

Prices for selenium (99.5%) in EU (2011-Jul 2014), $/kg

Thus, demand for selenium will depend from how selenium benefits and weaknesses will stand out against other alternatives within various consumption segments.

More information on the world selenium market can be found in the in-demand research study “Selenium 2015: World Market Review and Forecast”.