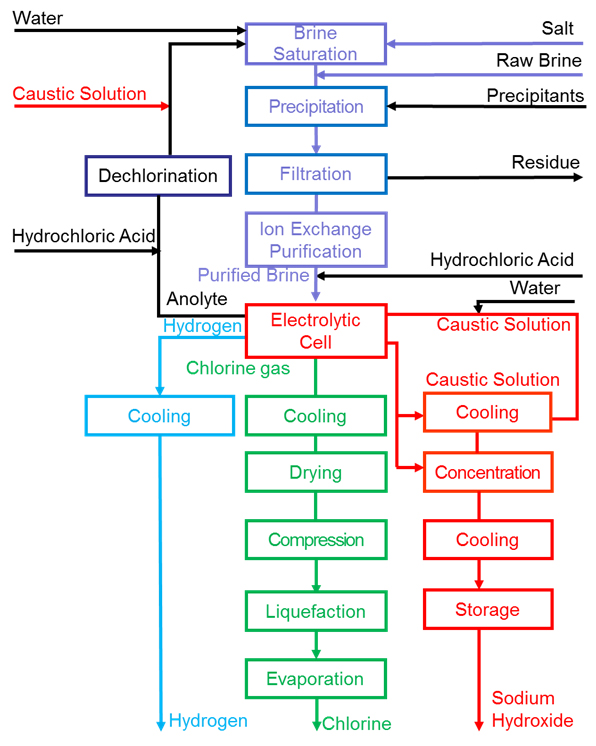

Regulatory activities, especially in the field of environmental protection, are viewed by many researchers as a source of discontinuity, technological change and even innovation. Interaction between regulation and technological change is strong, multi-dimensional, and consequential, primarily for an industry affected by this regulation. This statement fully refers to the chlorine industry. The major technological principle behind chlorine production hinges on passing of an electric current through a salt-water brine with ensuing separation of chlorine, hydrogen gas and sodium hydroxide (caustic soda). Dubbed as electrolytic process, it employs three various types of separation media: mercury cells, diaphragm cells and membrane cells. Of these three, the mercury cell process is regarded as the most environmentally hazardous due to its potential capacity to leak highly toxic mercury through the anthroposphere. The membrane-cell technology is more advanced and ecologically friendly as compared to those based on diaphragm and mercury cells.

The membrane cell process flowchart

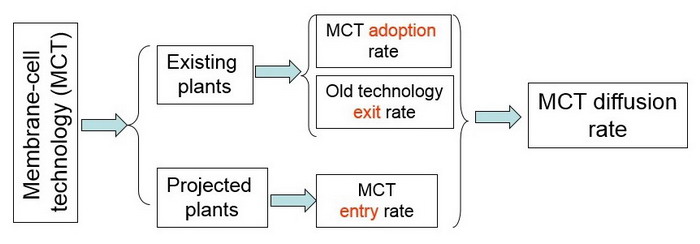

Thus, the diffusion of the membrane-cell technology in the chlorine market, which is backed by current environmental regulation, is inevitable. The rate of this diffusion depends on the manifestation of the following three variables: the rate of adoption of new technologies by existing plants, the pace of membrane technology entry to new plants, the amount of obsolete facilities closed due to outdated technologies (exit).

Membrane-cell technology diffusion process

In full accordance with the above figure, regulatory changes introduced by the European Union (EU) in the chlor-alkal industry could force the closure of old facilities which employ old technologies. The current EU regulation calls on chemical producers to convert mercury cell-based chlorine facilities to membrane technology or phase out old plants by December 2017. Companies like Evonik Industries and AkzoNobel, which plan to build an 82,000 mt/y chlorine membrane electrolysis facility in Germany in 2017, or Vencorex, which will commission a new 110,000 mt/y chlorine production unit, based on membrane technology, in 2016, have already made their choice. However, not all Western European producers will follow the suit, which may cause decline in chlorine production in European region by the end of forecast period. According to research company IHS, the technological transformation is likely to have significant impact on chlorine capacity in Western European markets with a reduction of around 1.8 million tons by 2018, while the Central Europe will witness a 0.6 million tons drop in chlorine production capacity. Despite this possible decline, the prospects for the European chlorine market look bright, buoyed by huge number of chlorine applications, general growth of the EU chemical market and bullish attitudes with respect to the EU economy.

More information on the chlorine market can be found in the insightful research study “Chlorine (CL): 2015 World Market Outlook and Forecast up to 2019”.