Butanediol (BDO) is an important industrial chemical; its major derivatives comprise tetrahydrofuran (THF, which is the largest outlet for BDO), gamma-butyrolactone (GBL) and polybutylene terephthalate (PBT). The latter three also act as intermediates. For example, THF is used to manufacture polytetramethylene ether glycol (PTMEG), which in turn is used to make thermoplastic urethane elastomers, Spandex and copolyester-ether elastomers. In case of GBL, the downstream sequence may be represented in the following way: BDO → GBL → N-methyl-2-pyrrolidone → copolymers.

Thus, BDO is a vital element in the long production chain composed of various intermediates and derivatives, which find their use in multiple industries and applications, including electronics, cosmetics, pharmaceutical and agrochemical industry, production of solvents, paints, coatings, adhesives, wetting agents, textiles, paper, etc. In such a role, BDO and its market become rather vulnerable as they are susceptible to multiple external influences. Just the opposite, BDO’s involvement in different commodity chains, as well as its versatility and importance steadily enhance the demand for this chemical.

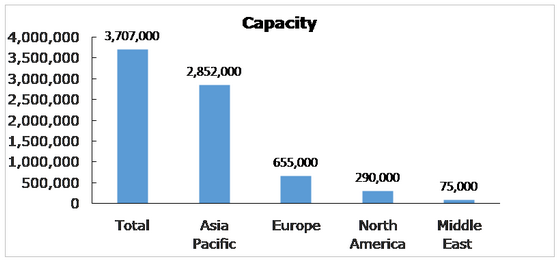

Thus, butanediol consumption in the world grows by healthy 7-8% per year and is expected to reach almost 3.2 mln. tons by 2019, which provide an upward pressure on prices. Regional patterns in BDO consumption growth trends show significant variance: 4% in North America / Europe and over 10% in Asia, where consumption is mostly driven by China. Such significant growth rate in Asia can only be catered for by constantly expanding production capacity in the region. Asia-Pacific (mainly China and Taiwan) accounted for over 73% of global butanediol capacity in 2014. The region is keen to fully cover its current BDO deficit and curtail BDO export in the future.

Butanediol (BDO): production capacity (metric tons) by region, 2014

However, despite new capacity expansion projects in Asia, the major BDO manufacturers prefer to process the bulk of BDO on the local market. Major butanediol manufacturers in Asia Pacific and their shares in the regional market in 2014 are as follows: Dairen Chemical Corp. (21.9%), BASF (11.2%), Sinopec Group (10.5%), Xinjiang Tianye (Group) Co. (7.0%) and Xinjiang Markor Chemical (5.6%). Ambitious plans to become one of the major BDO producers in China were envisaged by Shanxi Sanwei. Asian manufacturers will continue to improve their production technologies (by abandoning outdated Reppe process) and optimize existing capacities via M&A activities. North America and Europe will show quite different BDO market trends with very modest growth rates and few expansion projects.

More information on the butanediol (BDO) market can be found in the in-demand research study “Butanediol (BDO): 2015 World Market Outlook and Forecast up to 2019”.