Styrene is one of the most versatile hydrocarbon chemical blocks and intermediates with almost universal application. The global styrene market is a battlefield where multiple chemical companies, including top-tier petrochemical manufacturers like Styrosolution (a former 50/50 JV of Ineos and BASF and later a subsidiary of Ineos Industries Holdings), Dow Chemicals, Total Petrochemical or Petrochina, to name only a few, have to do its best in order to safeguard their competitiveness in light of the ongoing and expected economic, corporate, environmental and other challenges.

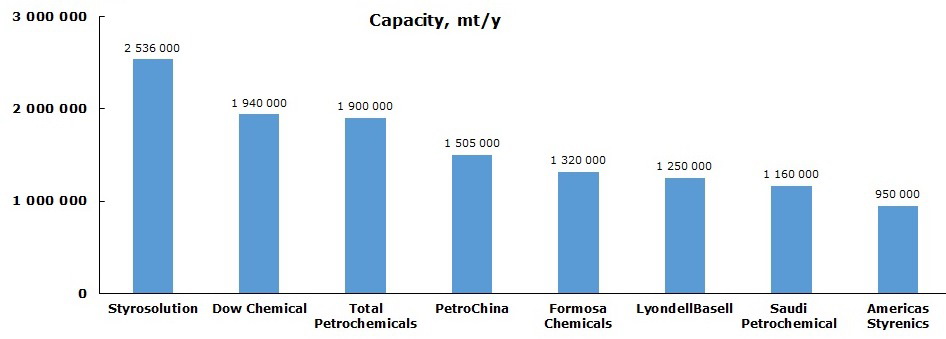

Major styrene producers and their capacity in 2013

Thus, styrene manufacturers undergo a phase of permanent and strong restructuring of their activities, rethinking of their focus, capacity shutdowns and consolidation, business re-orientation from one end-product to another, expansion project reconsideration and corporate reshuffling.

For example, in the middle of October 2012, Ineos Styrenics closed its 380,000 mt/y styrene monomer plant and its 180,000 mt/y polystyrene plant permanently, following the termination of the off-take agreement between Ineos and Styrolution.

Another vivid illustration of the trend is Dow Chemical, which closed the styrene monomer and ethylbenzene production units at its Freeport site in Texas, USA and Terneuzen, Netherlands by the end of 2009. The closures were part of a broad restructuring plan, which was designed to reduce Dow’s exposure to basic chemicals.

Total Petrochemicals’ styrene business in Europe has been also rescaled and consolidated at the Gonfreville complex, resulting in the shutdown of the Carling unit, in France. This reduced overall styrene production capacity by 120,000 mt/y.

The same challenging consolidation and restructuring processes are occurring in some mature Asian markets, for instance in Japan, where Asahi Kasei will close the older, 320,000 mt/y capacity styrene production plant in Mizushima in March 2016 to focus on the domestic Japanese market and in-house consumption or will be merging its naphtha crackers with Mitsubishi Chemical Corporation in April 2016.

Thus, maturity, complexity, versatility and the resultant challenging character of the global styrene market make the styrenics-related companies to constantly try to consolidate and restructure their businesses, rationalize the industry and get competitive edge by implementing new technologies and pushing the margins upwards in the light of changing market conditions in the end sectors, fluctuating benzene prices, new aromatic content environmental regulation, seasonal influences, varied inventories and other factors.

The global styrene market companies have to pay the closest attention to the scenarios of interaction between demand growth rates, prices for raw material and end products, capacity expansion plans and supply flows. For example, the operating climate for styrene manufacturers in the domestic Japanese petrochemical market is expected to be challenging with fall in demand and severe competition from low-priced imports. The understanding of this challenging climate of the global styrene market will make the companies act accordingly.

More information on the styrene market can be found in the insightful research study “Styrene: 2015 World Market Outlook and Forecast up to 2019”.