Antimony is a relatively rare metal which can exist in metallic and nonmetallic forms and can be used, as a pure metal (10% of applications) or in compounds (90% of applications), in a wide range of industries, including lead batteries, flame retardants, plastics, alloy strengthening agents, pigments, ceramics, glass, etc. China is a major antimony producer (with 80% share in global output). This country has the largest antimony reserves. In general, China is the biggest holder of rare earth minerals in the world, and it accounts for more than 95 percent of rare-earth mineral production worldwide, according to the U.S. Geological Survey.

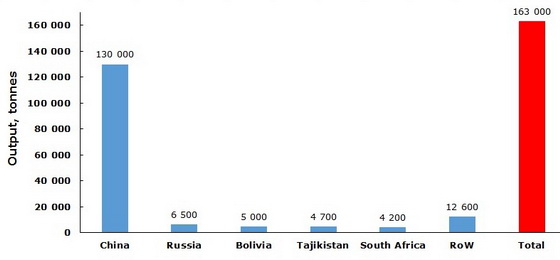

World antimony production by country in 2013, tonnes

The 3rd World Antimony Forum, which took place in Changsha (China) in May 20-21, 2015, described the situation on the Chinese antimony market as not particularly bright. The main characteristics used to define the Chinese antimony market were as follows: persistent oversupply throughout the whole 2014, not strong enthusiasm of domestic antimony manufacturers who operate under relatively low capacity utilization rates and lower profit margins, outdated production equipment, weak demand from downstream sectors, and decreasing prices for antimony and its related products (current antimony prices in China stand at $7,582-7,827 per tonne, demonstrating significant fall against the background of weak demand). It was mentioned that the sluggish Chinese market was also hit by the uncertain economic situation at many international markets, which are the main consumers of Chinese antimony. The Chinese antimony market demonstrates overcapacity with new projects coming ahead. This happens despite the fact that in 2009 the government of China classified antimony as a strategically vital metal, which caused supply constraints worldwide (EU regulating bodies acted in the similar way in 2014).

Local suppliers on the highly fragmented Chinese antimony market encounter with fierce competition, thus leading to production suspensions and closures. The state of things is further exacerbated by the rampant black market activity, despite the recent government’s efforts to seriously ‘tidy up’ the antimony industry in China by stopping illegal mining, taking the whole industry under control and rationalizing it for Chinese use.

It is worthwhile to mention that this situation occurs during the general decline in raw material supply in China over the recent years, which makes many local producers to seek overseas feedstock supply opportunities. The Chinese antimony market trends may take the following outlines. Chinese production and its share in the global antimony output are likely to decrease, but the country will keep the position of a leading supplier in the world market. Chinese production decline might be well offset by new capacity introductions in other areas with projects being evaluated and developed in Australia, Canada, China, Laos, Italy, Oman, Mexico, Turkey, Russia, Armenia, Georgia and other countries, so the overall antimony global supply will increase in the coming years. Chinese local price and industry trends will emerge as synergetic effect of several, often confronting, factors, including mainly general macroeconomic situation, both domestically and in other consumption regions, demand from downstream sectors, supply dynamics, regulatory initiatives and some other factors.

More information on the antimony market is available in the insightful research study “Antimony: 2015 World Market Review and Forecast”.