The total natural and synthetic industrial diamond production worldwide was estimated to hit 4.565 billion carats in 2014, of which synthetic industrial diamond production constituted 4.5 billion carats, accounting for about 98% of global industrial diamond output. The substitution of natural industrial diamonds for synthetic ones will continue as the latter outperform the former with respect to specifications and cost-effectiveness. Despite lower level of monopolization as compared to gemstone diamonds, the market for synthetic technical diamonds is still largely oligopolistic with just a few countries accounting for about 98% of the world’s synthetic industrial diamond production.

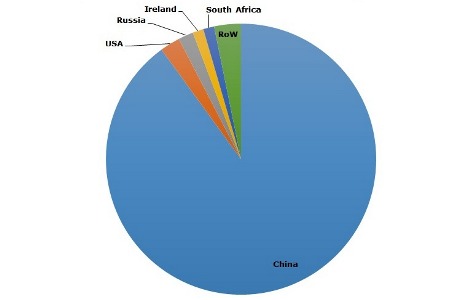

Synthetic industrial diamonds: structure of the global production by country, 2014

The market for natural technical diamonds exhibits wider geographic diversity, but its influence on the general situation with technical diamonds is negligible. China is expected to remain the world’s leading producer of synthetic industrial diamonds, followed by the USA. Today, Chinese market is dominated by three leading companies, namely Nanyang Zhongnan Diamond, Henan Huanghe Whirlwind and Zhengzhou Sino-Crystal Diamond. Some of the major players in the industrial diamond market include ALROSA, De Beers, Rio Tinto and Petra Diamonds. Demand for industrial diamonds is driven by the market for abrasives, which is considered the main end-use sector for industrial diamonds. The market for abrasives is expected to show stable growth in near future: its volume will exceed USD 39.8 billion by 2015, growing at 4.5% annually for the upcoming 5 years, stimulated by increase in durable goods manufacturing. This will lay the groundwork for robust development of the market for industrial diamonds.

More information on the industrial diamonds market can be found in the insightful research report “Industrial Diamonds: 2016 World Market Review and Forecast”.