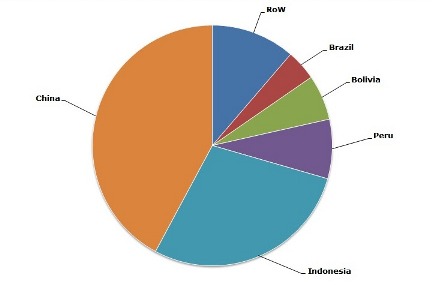

Tin mining and smelting exhibit fairly large level of monopolization with respect to geographic localization; they are also dominated by so-called developing countries. For instance, tin production is concentrated mainly in China and Indonesia, with both countries accounting for over 76% of global mine output. Similar rankings apply to tin smelter production, where leading positions are occupied by the following countries: China, Indonesia, Malaysia and Peru.

Tin: structure of the global production by country, 2014

Owing to tin market oligopolistic nature, any fluctuations on its key regional markets are therefore instrumental in influencing the global tin market, including demand and price dynamics. For instance, Indonesia, which used to be a major tin exporter, implemented strict tin export policies in 2009 in an effort to prevent illegal tin mining and smuggling, decrease environmental impact from the local tin industry, improve tax collection and execute better control over the tin sector in general. Imposed measures have tightened the exports from Indonesian smelters (including to China) and led to price spikes. The Indonesian tin industry was also heavily impacted by the later decision of the Indonesian government to curb down mineral ore export by passing a controversial law which required local mining companies to build smelters to process ore domestically. As prices for many metals drop, Indonesian tin-smelting capacity simply have no opportunity to catch up, which, coupled with tin export curtailment, was detrimental for the whole Indonesian tin sector. Currently, Indonesian government is mulling a possibility of changing this regulation. As a result, complex feedback relationships, underlying the interactions between Indonesian tin sector and the world tin industry, predicated the current complicated situation on the Indonesian tin market.

More information on the performance of the tin market can be found in the research report “Tin: 2016 World Market Review and Forecast”.