Britain’s vote to leave the European Union has already rendered certain detrimental effect on the European and primarily UK fertilizer markets. The British fertilizer market is not particularly big, with clear predominance of NPK fertilizers and just a very small share of potassium sulphate (SOP) fertilizers. However, the ripple effect of the Britain’s decision has been already quite palpable, at least on the corporate level, where it has taken its toll in the form of fallen stock markets.

Other implications may soon follow and bring the introduction of new trade barriers and reformatting of some regional markets to different suppliers. This is especially vital for fertilizer exporters from Germany, which has always been a key potash supplier to the British market.

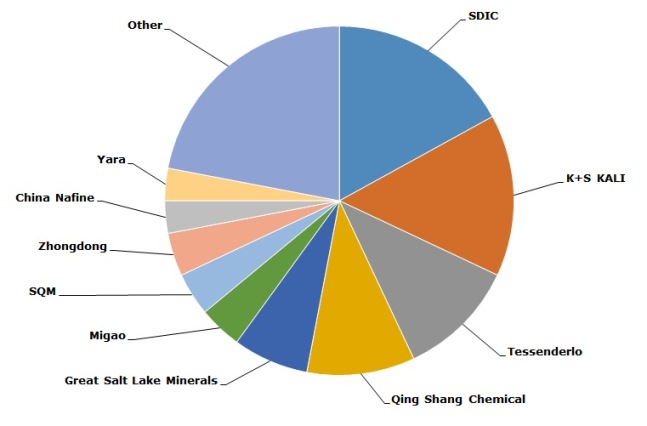

Potassium sulphate: structure of the global production capacities by major manufacturers

Two major suppliers of fertilizers to the UK market are Germany’s K+S Kali (K+S) and ICL UK (formerly Cleveland Potash) with a mine in Boulby (at the North East of England). Both have already experienced a vivid plunge in share prices since the vote result announcement. Of course, for such major potash players as K+S Kali, which is the fourth largest potash supplier and the second largest producer of potassium sulphate in the world with a diversified portfolio of products and projects all over the world, the consequences might not be that sizeable. However, the current political and economic uncertainty, which has a strong chance to increase in the short-term future, against the background of significantly lower average selling prices for potash and magnesium products in the second quarter 2016, is highly unwelcome.

More information on the potassium sulphate (SOP) market can be found in the topical research report “Potassium Sulphate (SOP): 2016 World Market Outlook and Forecast up to 2020”.