Building and construction applications are the largest outlet for expandable polystyrene (EPS), accounting for around two-thirds of its demand, though construction-related EPS application grows faster than EPS use in packaging. Other promising expandable polystyrene applications include furniture and sports accessories. The present EPS market can be characterized by several key features. Firstly, the market undergoes a stage of capacity rationalization and market optimization with facility closures and debottlenecking, etc., paralleled by the robust introduction of EPS capacities in Middle East and Asia Pacific countries, though due to overcapacity in the global EPS market there are no huge increases planned. Joint venturing, establishing different consortiums and M&A activities are also quite common. For example, in 2005 Nova Chemicals and Grupo Idesa signed an agreement to establish a 50:50 joint venture in Mexico. The market restructuring is also spurred by high level of EPS market fragmentation. In North America alone, which accounts for a very small share of the EPS market, EPS is manufactured by nearly a dozen of manufacturers, including StyroChem International, Dart Polymers, Flint Hills Resources, Grupo Idesa, Nexkemia Petrochimie, Plasti-Fab Nova Chemicals and Styropek.

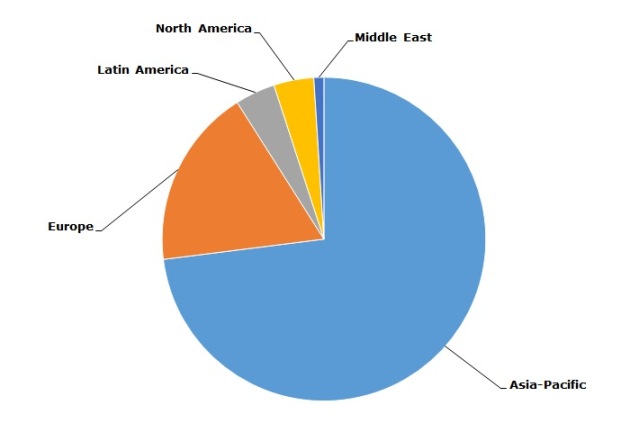

Expandable polystyrene: structure of the global capacity broken down by region, 2014

EPS market reshuffling, particularly in Europe, will be also strengthened by the current uncertainty and volatility, prevailing on the EU market after the Brexit referendum. Several EPS manufacturers have already stressed that with a possibility of the UK leaving the EU in the near future, the trade and manufacturing may become more complex. This might not happen, but current uncertainty is already a real thing, affecting expandable polystyrene market environment and taking it toll on corporate plans and styrene prices. Among other uncertainties, EPS manufacturers mentioned unclear destiny of the European Union REACH regulation, which addressed the production and use of chemical substances in Europe. EPS market fragmentation is also exacerbated due to disproportionate capacity distribution from region to region with Asia Pacific accounting for over 70% of all EPS production capacity (China alone accounts for over 60%).

More details on the global expandable polystyrene market can be found in insightful research study “Expandable Polystyrene (EPS): 2016 World Market Outlook and Forecast up to 2020”.