The current situation on the global urea market can be characterised by a fairly large degree of uncertainty, which might be typical for end-of-the-year seasonal fluctuations when players are apprehensive on the verge of a new crop-sowing season and unsure which trend will be dominant. However, the uncertainty is exacerbated by a range of other factors, including the unstable behaviour of the main urea markets, which are India and China.

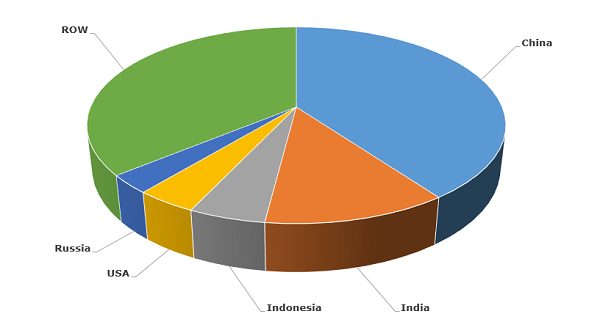

Urea: structure of the global capacities by country

Many regional urea markets have presently encountered with high urea inventories (e.g. in India, China and other countries). There are also numerous projects running to boost urea capacity; they are being realized in different parts of the world, including China, Indonesia, Russia, Qatar, Pakistan, Iran, Egypt, Saudi Arabia, Oman and Romania. Overcapacity is a dominant trend, backed by stifled demand, low capacity utilization rates (e.g. around 50% in China), increased production costs, and other factors affecting demand (e.g. demonetisation of higher currency notes in India or the cancellation of the urea tender by government-owned State Trading Corporation of India). However, despite uncertainty, overcapacity and reduced demand, urea prices can augment at some markets, for instance in China, where producers are confronted by a range of issues, exerting an upward pressure on prices. Urea imports and exports demonstrate extremely varied dynamics both globally and regionally. For instance, urea imports are currently falling in the USA, and in the near future might augment in India when new urea prices are agreed. Urea exports by China are anticipated to grow if urea export tax in China would be reduced or abandoned.

More reliable updated information on the world’s urea market can be found in the insightful research report “Urea: 2016 World Market Outlook and Forecast up to 2020”.