Polyvinyl acetate is an aliphatic polymer made by polymerization of vinyl acetate monomer (VAM). Polyvinyl acetate absorbs nearly half of VAM. VAM itself is a highly versatile intermediate used in the production of polyvinyl alcohol (PVOH), ethylene vinyl acetate (EVA) polymers, ethylenevinyl alcohol (EVOH) and polyvinylbutyral (PVB). VAM is in turn a product of several other raw materials, including acetic acid, ethylene and oxygen. As such, PVA is embedded in complex chemical chains and the PVA market is affected by commercial and technological trajectories of various upstream and downstream products. All of these polyvinyl acetate feedstocks and outlets are influenced by multiple factors, including import duties (e.g. acting 5.5% VAM import duty in Europe); fluctuations in manufacturing costs and supply conditions (e.g. the interaction between acetic acid supply and VAM costs, which led to acetyl price rise in the US in February 2017); production bottlenecks or debottlenecks (e.g. Celanese’s debottlenecks in acetic acid facility in North America in 2015), seasonal fluctuations and other market conditions.

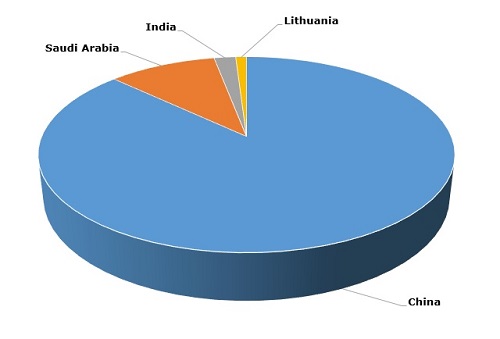

The largest markets for polyvinyl acetate are adhesives (40-45% of the total) and coatings (35-40%), followed by textiles, paper, and construction. Roughly 50% of polyvinyl acetates are consumed as homopolymers, with the rest consumed as copolymers containing monomers such as n-butyl acrylate, 2-ethylhexyl acrylate, ethylene and esters. Currently, the global polyvinyl acetate market is fully dominated by Chinese manufacturers, like Inner Mongolia Mengwei Technology Co Ltd. (a subsidiary of Wanwei Group), Shanxi Sanwei (Group) Co. Ltd, Anhui Wanwei Group Co., Ltd. and Beijing Organic Chemical Plant.

Polyvinyl acetate: structure of the global production by country, 2015

This monopoly is likely to persevere, which results in the fact that South East Asia will continue to play a decisive role in the behaviour of many regional PVA markets. This dominant role is also strengthened by China’s having major VAM-manufacturing capacities. Asia also remains the largest consumer of polyvinyl acetate with a share of 49% of the global total consumption.

More information on the polyvinyl acetate market can be found in the insightful research study “Polyvinyl Acetate (PVA): 2017 World Market Outlook and Forecast up to 2021”.