Cumene is an important intermediate in the chemical chain leading from refinery-grade propylene (RGP) and benzene (which have precursors as well), via their catalytic alkylation, to other chemicals, including predominantly phenol and acetone, followed by a number of chemical and end-products. The length of this chain, which involves multiple commodities, coupled with a dynamic complexity of the surrounding economic, technological, regulatory and other environments, make the cumene market susceptible to different influences and involved in various feedback loops of interactions.

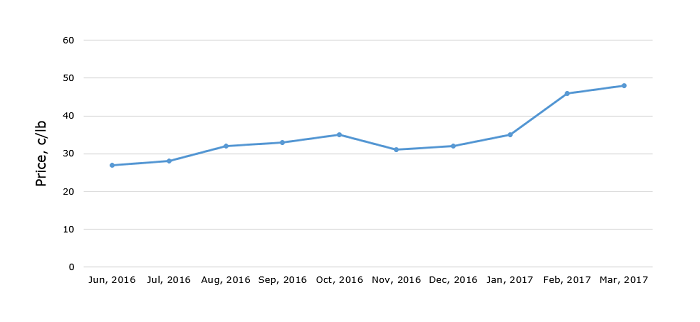

This enhances overall volatility of the cumene market. For example, recent (Feb 2017) uptake in RGP costs, also supported by healthy demand for cumene, has led to an increase in cumene prices in the USA.

Cumene: FOB contract prices for in the USA (June 2016 – March 2017)

Actually, the rise in prices went downstream along the whole above-mentioned chain as phenol and acetone prices followed the suit, (though it is not always the case as price dynamics for various components in the chain should not necessarily coincide in direction). In this case, the planned turnarounds at some US-based phenol and acetone facilities were not sufficient to offset demand growth.

The recent upsurge in cumene prices in the USA, though it might be levelled off at a certain point in time, when some sort of balance is reached and inventories are built up, is a manifestation of a bigger trend. This trend demonstrates a steady growth in interest for cumene. The interest rests on the fact that cumene is an important chemical building block indispensable in phenol/acetone production with a potential of versatile applications in other areas (styrene precursor, production of thinners, solvents, detergents, paints, etc.).

More information on the cumene market can be found in insightful research study “Cumene: 2017 World Market Outlook and Forecast up to 2021”.