Scandium is a soft, silvery-white metallic element that might be viewed as a representative of the rare earth class of natural elements. This class includes lanthanides, such as yttrium and scandium. The latter has properties which make it possible to be used in solid oxide fuel cells (SOFC’s), high-strength aluminium alloys, high intensity metal halide lamps, ceramics, electronics, and laser research.

The market for scandium is poorly structured and monitored. Available scandium resources in many countries are not mined, while some are depleted. There is no formal buy and sell market today; it is not traded on a metals exchange. Scandium is sold and bought by private parties; prices and amounts of those deals remain undisclosed.

Currently, there are no primary scandium producers and the global scandium supply is very short. However, there are constant efforts to boost scandium production.

Companies like Metalysis, Rio Tinto, Rusal, Rhodia, etc. are among active participants of this process, which periodically invigorates or slows down. For instance, Rusal sees large potential in developing production of complex scandium alloys. According to Rusal, such alloys act as a perfect material for high performance products and are a true source of competitive advantage. Of course, scandium-related projects require significant investment (though potential for payback is also very good due to extremely high prices for scandium oxide or scandium alloys) and sophisticated metal recovery/production technologies; such projects also take a lot of time to come to fruition.

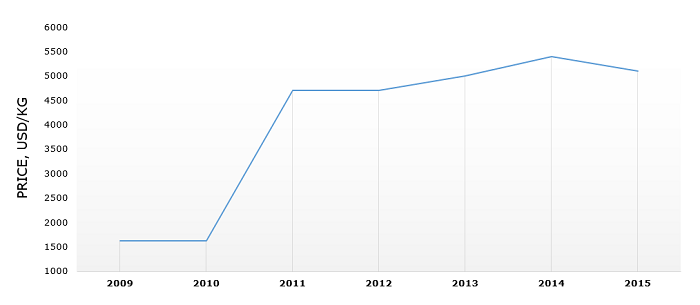

Dynamics of prices for 99.99% purity scandium oxide during 2009-2015, USD/kg

For example, Rusal announced the production of scandium concentrate at its Urals aluminium smelter in 2014, and only in late 2016 the first batch of scandium oxide was produced. The company has been developing an advanced technology for scandium extraction from red mud, constantly increasing metal recovery rate and scandium oxide content in the concentrate. Rusal mulls plans to boost annual scandium production initially to 2-3 tons with a potential of producing 10 tons per year.

More information on the global scandium market can be found in the in-demand research study “Scandium: 2017 World Market Review and Forecast”.