Adipic acid (ADA) is a large-scale chemical product embedded in the nylon-66/nylon-6 production chain which also features upstream benzene, cyclohexane and hexamethylenediamine. The bulk of cyclohexane is used to produce adipic acid and caprolactam (capro). With other outlets, including downstream polyurethanes, plasticizers, coatings, detergents, washing machine tablets, etc., adipic acid is a versatile commodity manufactured and traded by different countries.

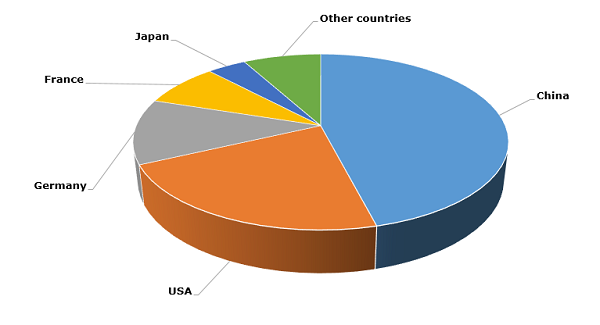

Adipic acid: structure of the global production capacity broken down by country

Regular ADA market developments are characterised by the interplay of several factors, mainly feedstock cost fluctuations, demand for its end-products, ample/tight supply volumes, status of inventories, production facility turnarounds/closures/expansions (e.g. the shutdown of Invista’s 220,000 t/y plant in Orange, Texas), seasonality, environmental legislation, technological innovations and other factors. For example, the influence of technological innovations and environmental concerns on the adipic acid market manifests in the efforts to develop the production of bio-based adipic acid. Start-up companies, like Verdezyne, Celexion, BioAmber, Genomatica and Rennovia, have recently piloted bio-based projects to produce adipic acid, with a target to create pure (100%) bio-based nylon. However, these efforts are still at an early demonstration stage. In addition, the above-mentioned factors affect the adipic acid market at different levels, subject to specific geographic area, temporal dimension and application niche. Current healthy demand for adipic acid in Europe is instrumental in pushing cyclohexane prices upward, while among many Chinese producers the sentiments related to adipic acid are nowadays mostly bearish.

More information on the adipic acid market can be found in the in-demand research report “Adipic Acid (ADPA): 2017 World Market Outlook and Forecast up to 2021”.