Platinum group metals or PGM (platinum, palladium, rhodium, iridium, ruthenium, osmium) form a uniform, yet fairly diverse with respect to market trajectories, selection of rare metals with unique properties and a wide application range. This range mainly centers on high-tech applications, like catalytic converters in vehicles (which account for the bulk of PGM consumption) and catalysts in the petrochemical industry, electronic industry devices and components (capacitors, ICs, PC hard disks, etc.), as well as laboratory, medical and biomedical applications. PGMs, especially platinum and palladium, are also products of fashion, prestige and investments in the form of jewelry and exchange-traded products, as well as through the individual holding of physical bars and coins. This alone makes them quite unique commodities. Affected by a multitude of interdependent factors, including mainly macroeconomic situation, feedstock costs and consumption trends, the market for PGMs is prone to volatility, uncertainty, insufficient financing, concerns about the mining safety and environment, and new form or mineral nationalism, exhibited by various countries and manifested in multiple trade barriers. For instance, the price for platinum is a vivid example of such market volatility and uncertainty.

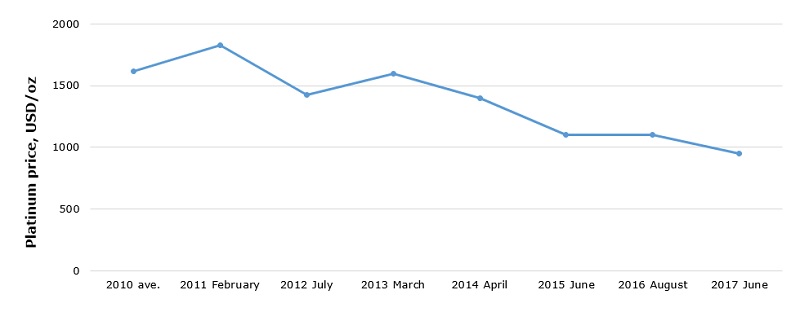

Platinum price dynamics, USD/oz (2010-2017)

Irrespective of this market uncertainty, the prospects of the PGM market look good. Despite the decreasing demand for catalytic converters based on platinum, the platinum market is expected to witness growing demand from industrial and chemical industries in North America, Europe and China. The same will be true for the jewelry market, especially in Asian countries. Global palladium consumption will continue to increase, especially in the catalytic converter industry. In 2016-2020 the tendency of shifting away from platinum toward more palladium in the automotive industry is expected. Demand for rhodium is predicted to rise by 6%, backed by strong car sales and tighter legislation in China, and greater use of lean nitrogen oxides (NOx) absorbers in Europe. Lean NOx absorbers, combine three active components: an oxidation catalyst such as platinum, an adsorbent such as barium and/or other oxides, and a reduction catalyst such as rhodium. Glass making and chemical industry will exhibit a strong demand for rhodium too. The iridium market may demonstrate a downward trend as demand for iridium drops, but this drop will not be significant enough to diminish the interest in this metal.

More information on the platinum group metals market is available in the in-demand research report “Platinum-Group Metals: 2017 World Market Review and Forecast”.