The recent developments of the methyl methacrylate (MMA) sector, marked by very tight supply, strong demand and price hikes, fit well into the general picture of uncertainty and volatility from both current macroeconomic perspective and the MMA sector specifics. The synergy of various factors, including large intrinsic imbalances of the MMA market (the MMA market remains largely oligopolistic), technical issues at some MMA-producing facilities, seasonal turnarounds, production rate reductions and steady demand from plastics and coatings downstream segments, caused a ‘perfect storm’ scenario to come true.

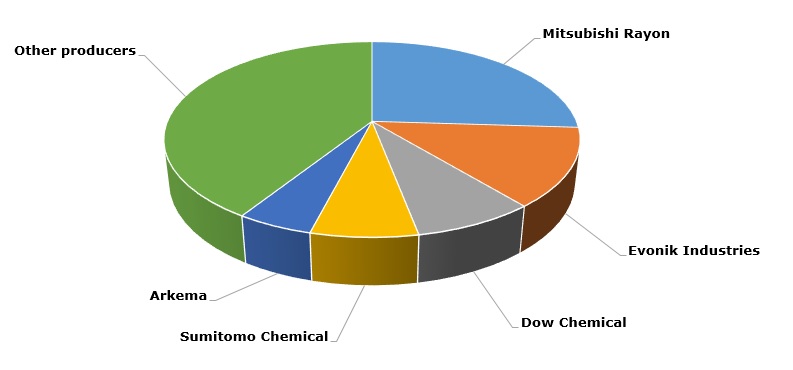

Methyl methacrylate: production capacities by manufacturer (2015)

Some additional MMA quantities may eventually come from Saudi Methacrylates Company (SAMAC), which is a joint venture (JV) between Mitsubishi Rayon (MRC) and Sabic. SAMAC plans to launch a 250,000 mty methyl methacrylate (MMA) plant at Al-Jubail, Saudi Arabia (coupled with a 40,000 mty polymethyl methacrylate (PMMA) plant at the same location). However, commercial operation of the plant will take some time to fully unfold after the commissioning, so the facility may render any noticeable effect on the market not earlier than H1 2018. This means that the stringent situation with MMA supplies, which entailed its price rise, will hardly improve until the end of the year. As alluded above, this state of affairs only confirms the general instability of the MMA market, which is susceptible to large fluctuations, like the one which occurred in 2015 when the MMA price demonstrated a significant drop.

More information on the methyl methacrylate (MMA) market can be found in the in-demand research study “Methyl Methacrylate (MMA): 2017 World Market Outlook and Forecast up to 2021”.