The dynamics of the caprolactam (capro) market is largely dependent on the behaviour of its upstream and downstream sectors. Upstream here means predominantly cyclohexane since approximately 68% of the world’s caprolactam is produced from cyclohexane, which in turn relies on benzene. Downstream predominantly implies synthetic fibres, especially nylon 6. Of course, the relationships along these downstream-upstream chains are not linear, but rather dynamic with lots of response delays, dynamic complexity and feedback loops. Likewise, the recent movements on the caprolactam market are marked by quite notable fluctuations caused by complex interactions of different factors. In spring and early summer of 2017, caprolactam supply tightness was evident. This tightness seems to subdue now, leading to better supply situation in July and August. Caprolactam prices follow similar trajectories, being mostly driven by supply situation and downstream changes in nylon demand and prices. Such dynamic is highly characteristic of Western Europe, where caprolactam consumption has been stagnating or decreasing with relatively the same rate as the consumption of engineering polymers has been growing. In general, caprolactam consumption has been transferring to Asia-Pacific, following relocation of nylon 6 supply chains and production, which have been moving to Asia-Pacific as well.

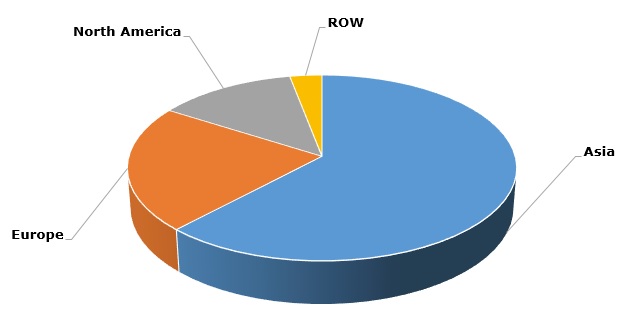

Caprolactam: structure of the global consumption broken down by region (2016)

For instance, Asia-Pacific’s share in PA6 and PA66 production grew from 35% in 2001 to 51% in 2015 (the demand for both polyamides in Asia-Pacific hit 58% of global demand). A decisive role of the Asia-Pacific region in synthetic fibre consumption and production forms a steady and long-lasting trend. This trend will be crucial in determining the future behaviour of the capro market.

More vital information on the caprolactam market can be found in the in-demand research study “Caprolactam (CPL): 2017 World Market Outlook and Forecast up to 2021”.