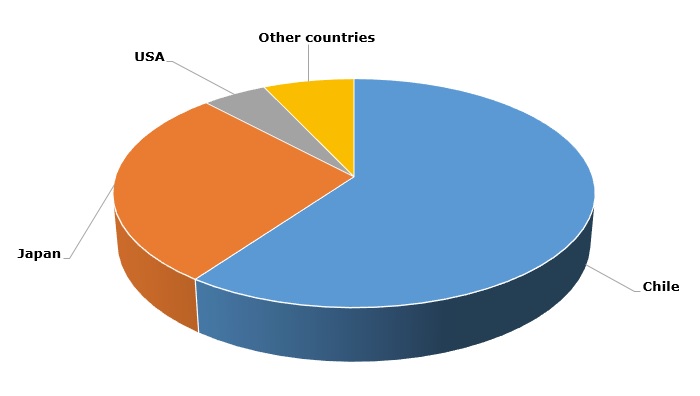

Large monopolization of the global iodine market, both on corporate and regional levels, leads to iodine supply and price fluctuations, augmented by various factors. Chile, which is the world largest iodine manufacturer with a growing production potential (with 60% of global iodine output and this share is increasing), is especially impactful on the global iodine market. For instance, reported reductions in iodine output by some Chilean iodine producers impinged on iodine prices in 2017.

Iodine: structure of the global output by country (in 2014)

However, price increases were not as dramatic as it was expected. It is therefore more proper to speak about stability of iodine prices during H1 2017 rather than their sharp increases. In other countries, some companies, like Iofina, performed well in the first half of 2017 with respect to meeting its production targets despite struggling with manufacturing issues (e.g. Iofina’s IO#3 iodine facility shut-down in the USA due to problems with water and brine). However, it should be borne in mind that in Japan and the USA, the second and the third largest producers respectively, iodine production growth has been remaining rather flat over the recent years, so their impact on the global iodine market will likely continue to shift to the consumption side. Healthy demand for iodine and iodine-based products from various application sectors was also instrumental in pushing iodine prices up in H1 2017. The stability of the demand for iodine, including from a number of innovative high-tech sectors, is an important long-lasting factor, which will determine its market development in the near future. This stability is closely associated with iodine unique properties and status, as well as its importance in daily life of humans.

More information on the iodine market can be found in the in-demand research study “Iodine: 2017 World Market Review and Forecast”.