The global potash market demonstrates volatility and large price fluctuations. It is true in the case of regional markets though some of them can demonstrate bigger stability, especially in fixing prices (e.g. China). This volatility is multi-faceted, dynamic, complex and driven by various factors. For instance, in 2013 Belaruskali and Uralkali, representing Belarus and Russia, respectively, undertook an attempt to form an alliance.

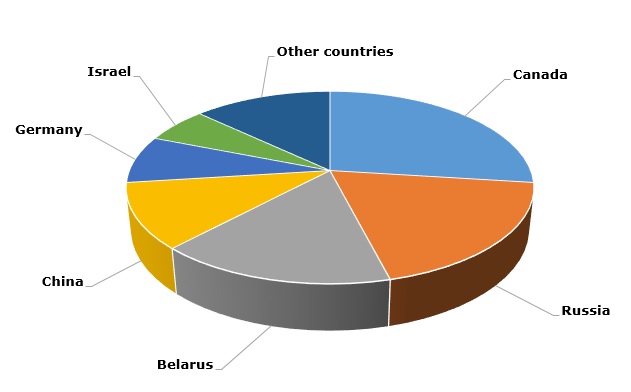

Potash: structure of the global production by country, 2015

This attempt of the two key potash-producing companies (and countries) to unite forces failed dramatically the same year. This failure resulted in reduced prices and decreased revenues, coupled with large market fluctuations and weakened positions of these two players (despite the fact that their potash production volumes grew in H1 2017). The recent (June 2017) decision by Belaruskali to reduce a potash export duty from €55 to €20 per tonne signifies that Belarus is likely to continue the previous efforts to obtain the bigger stake of the international market, especially in China, by sticking to former policy of ‘volume over price’. China made large investments into the development of potash salt deposits in Belarus, which helped the country to secure contract volumes among Chinese customers or, more precisely, assisted Chinese potash buyers to purchase Belarussian potash at lower prices. Belarus has recently made a large contract with Chinese potash consumers at about USD227 per tonne. Mikhail Gutseriyev’s Slavkaliy, which obliges to sell its potash via Belaruskali, will likely to follow the suit by selling its potash to China. Currently, all major international potash producers are taking efforts to find buyers on the Indian market.

More information on the potash market can be found in the insightful research study “Potash: 2017 World Market Review and Forecast”.