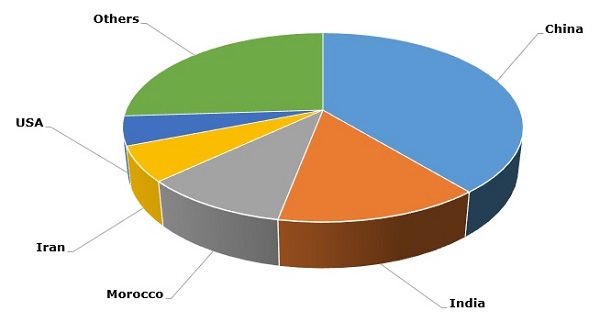

The main end-use application for barites, which are primary, naturally occurring barium-based minerals, is the oil and gas industry where barites are used as weighting agents in drilling muds: the oil and gas exploration sector accounts for about 75 of barite consumption worldwide. Chemicals, paints, fillers, coatings, contrast media and some other applications make up the rest. China dominates global barite production with about 40% of world total output, followed by India, Morocco, Iran and the USA.

Barite: structure of the global production by country, 2016

The USA is still the largest consumer of barite, followed by Middle East and China. The world barite market is largely driven by global and regional demand for barites, which is highly susceptible to the state of the oil and gas exploration industry. Specifically, the US demand for barites (governed by local oil and gas industry) is of key importance since this country is the largest barite consumer. To this extent, the count of active oil and gas drilling rigs has long been considered a good indicator of barite demand (this count is actually a highly flexible and dynamic indicator, influenced by multiple factors). For instance, in 2016 global barite production decreased, falling to 7.14 million tonnes from 7.41 million tonnes in 2015 mostly as a result of the depressed oil market. Unsurprisingly, in 2016, the U.S. weekly average rig count reached its lowest level since the start of the count in the 1940-ies.

More information on the barite market can be found in the all-round market research report “Barite: 2017 World Market Review and Forecast to 2027”.