China plays a dominant role in the global chlorine market. The country’s chlorine-manufacturing capacity is over 40 mln tonnes per year; the actual chlorine output is about 30 mln tonnes per year.

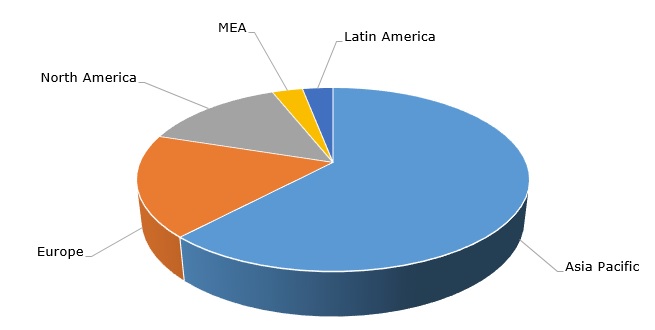

Chlorine: structure of the global production capacity broken down by region

This incumbent status makes any changes on the Chinese chlorine market instrumental in affecting the whole situation worldwide, especially when other factors dynamically interact. For instance, current anti-pollution measures undertaken by the Chinese authorities render significant impact on the global chlor-alkali industry. Such activities are able to diminish available national production capacity (mostly by shutting down environmentally hazardous production facilities in China), reduce capacity utilization rates and tighten Chinese chlorine exports. Foreign buyers now often have to look for feedstock elsewhere. This is further exacerbated by the curtailments of European chlorine capacities, affected by phasing out of mercury cell-based chlorine facilities and their conversion to membrane technology in accordance with the current EU regulation, effective December 2017. This provides an upward pressure on chlorine prices and causes US manufacturers to operate at upper limits of their capacity utilization rates. This market scenario will become more pronounced throughout 2018, buoyed by possible elements of political instability in China, especially in the light of Chinese President Xi Jinping’s decision to extend his presidency beyond current constitutionally allowed 10-year term.

Find more info on the chlorine market in the in-demand study “Chlorine (CL): 2018 World Market Outlook and Forecast up to 2027”.