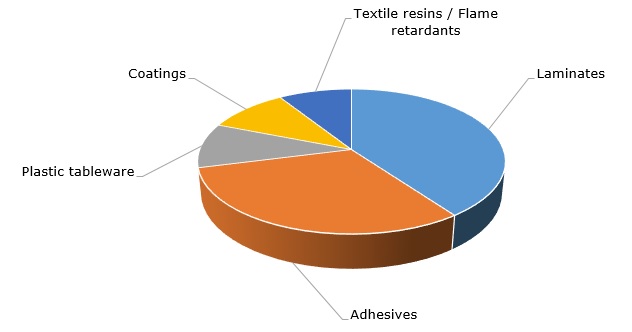

The wood-based panel industry with its subsectors focused on laminates and adhesive resins is considered the largest outlet for melamine. Both subsectors (i.e. laminates and adhesives) jointly account for over 70% of melamine consumption globally.

Melamine: structure of the global market by application

However, this figure reflects a generalized picture of melamine use in global terms, and regional use patterns might vary.

In the EMEA region, the combined share of these two subsectors in melamine consumption is even bigger, but, in Asia-Pacific, it is less pronounced with the second largest segment being plastic tableware. In Americas, melamine consumption pattern is different as the major outlets for melamine are laminates, coatings, and textile resins/flame retardants, while the share of the adhesives segment in melamine consumption remains relatively small. This diversity deepens when further regional contingency is implied.

The similar regional variability exists on the level of market dynamics which often demonstrates a variety of trends. Currently, the demand for melamine in Asia-Pacific eases off, while it is quite robust in Europe, mostly triggered by macroeconomic and supply situation. Likewise, in the case of melamine consumption by segment, variability of market dynamics increases with narrowing down localization. For instance, current demand for melamine in Southern Europe shows different dynamics as compared to other regions of Europe. In general, melamine market remains highly volatile, driven by macroeconomics, supply-demand relationships, environmental and health protection regulation (different countries monitor melamine-induced health risks and express concerns to this extent) and other factors.

More information on the global melamine market can be found in the in-demand research study “Melamine: 2018 World Market Outlook and Forecast up to 2027”.