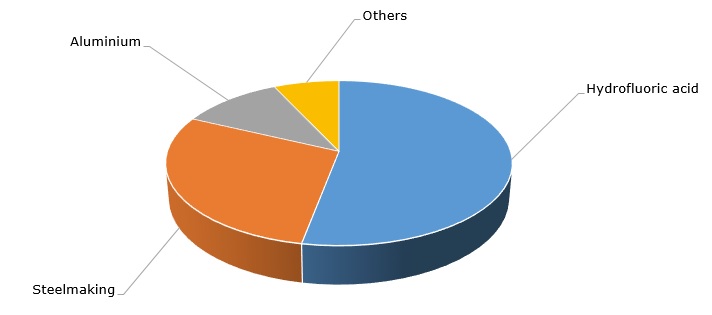

Fluorspar is applied in the production of hydrofluoric acid (which is a feedstock for fluorine-containing compounds, incl. fluoropolymers), steelmaking, aluminium manufacturing, and other consumption sectors. It is included in the regularly updated list of critical raw materials (CRMs). The list was originated by the European Commission to define most critical feedstock elements of the European manufacturing value chain (the current list was updated in 2017).

Fluorspar end uses

According to this important document, the main suppliers of fluorspar to the EU during the period of 2010-2014 were the following five countries: Mexico (38%), China (17%), South Africa (15%), Namibia (12%), Kenya (9%). Such a breakdown of chief suppliers of fluorspar to the EU somewhat contrasts with top five global fluorspar manufacturers, which are as follows: China (64%), Mexico (16%), Mongolia (5%), South Africa (4%), and Russia (4%). This discrepancy is easily grasped when one recalls, for instance, that China prefers to consume the bulk of produced fluorspar domestically, (the approach shared by many small fluorspar producers), while Mongolian and Russian fluorspar supplies are hindered by issues with quality and logistics. Actually, for the above reasons, fluorspar is mainly traded on a contract basis and only small amounts of it enter the international trade in the open market.

The EU report dedicated to CRMs also confirms that fluorspar is hard to substitute (substitution index for fluorspar is equal to 0.98/0.97). Most noted fluorspar substitutes in aluminium flux application include aluminium smelting dross, borax, calcium chloride, iron oxides, manganese ore, silica sand, and titanium dioxide.

Fluorinated polymer wastes can become another interesting substitute of fluorspar. These wastes may reduce consumption of acid-grade raw material fluorspar. This could happen, for instance, via the use of up-cycling technology developed by fluoropolymer producer Dyneon, a subsidiary of US industrial products and services group 3M.

Fluorspar also predominantly relies on primary (mining) sources. According to the above-mentioned report, fluorspar has a very low end-of-life recycling input rate (at around 1%).

More information on the world’s fluorspar market can be found in the in-demand research report “Fluorspar: 2018 World Market Review and Forecast to 2027”.