Well-balanced potassium nutrition is indispensable for crop yield, plant health, and its quality, thus providing a huge economic, social and environmental impact, especially in developing countries, which are among the major consumers of different types of potassium fertilizers. Numerous researches confirm that the application of potassium sulphate (K2SO4) or sulphate of potash (SOP) is beneficial for the health and productivity of various crops.

While the positive effects of SOP use are indisputable, farmers may feel less prone to use this type of fertilizers due to its higher cost, as farmers often prefer to buy less expensive fertilizers, keeping in mind the general value for the money.

Of course, from the perspective of SOP producers, (often these are large, vertically integrated companies, which manufacture a wide range of fertilizers), the margins associated with SOP-selling business may look more attractive as compared to, for instance, muriate of potash profitability.

The current rainfall deficiency in Europe will also require changing fertilizer application patterns and routines, which may also affect the SOP market.

The application of SOP fertilizers may be impeded by new environmental legislation that strives to drastically reduce atmospheric sulphur dioxide depositions as they might increase thanks to the application of sulphur-based fertilizers.

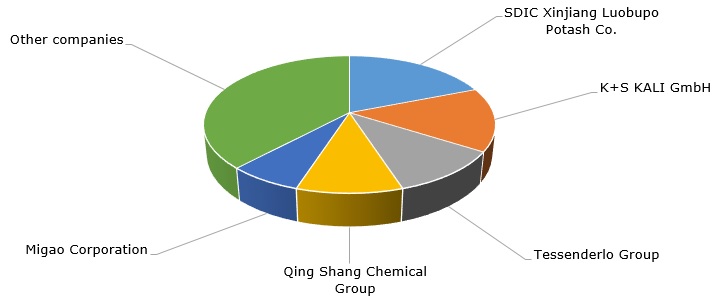

Another factor that can adversely affect the SOP market is a complexity of its production. SOP can derive from primary and secondary sources. The primary sources, which are salt lake (brine) deposits, are located in a few countries, like China, India, the USA, Chile or Australia. The latter country may become a major producer of primary-sourced SOP due to the activities of companies such as Agrimin (the Mackay project with a potential to produce 370k mta of SOP) and Kalium Lakes (the Beyondie SOP Project in Western Australia with a target capacity to produce 150k mta of SOP). The secondary production of SOP, like the Mannheim process, could be costly and cumbersome, leading to the necessity to dispose of hydrochloric acid as a by-product. In general, SOP production capacity is quite monopolized as the top five manufacturers account for over 60% of global SOP production capacity.

Major potassium sulphate manufacturers

The complex character of manufacturing and its excessive monopolization can also act as barriers to the SOP market development.

More information on the potassium sulphate market can be found in the in-demand research report “Potassium Sulphate (SOP): 2018 World Market Outlook and Forecast up to 2027”.