Purified terephthalic acid (PTA) is a large-tonnage commodity and intermediate, which acts as an element of the complex value chain, consisting of upstream paraxylene and downstream products, including polyester fibre and non-fibre applications such as PET-bottles, PET-films, and engineering plastics. The complexity of this chain stipulates high PTA market volatility. This volatility is predicated on multiple factors. The demand-supply balance plays the central role, oscillating between feedstock paraxylene dynamics and the situation in the consuming sectors. Secondly, seasonal factors are important. For instance, the summer season usually means larger PET-bottle sales, thus increasing PTA consumption. Key market factors include production issues and maintenance schedules. The current China-US trade war may also impinge upon the PTA trade flows, though the degree of this influence is hard to predict. Many PTA producers are large vertically-integrated global companies. They could switch the PTA deliveries to other destinations or source them from their subsidiaries elsewhere, if necessary. However, China and the USA are two major PTA market players, so the trade discrepancies between two major economies could have all sorts of feedbacks.

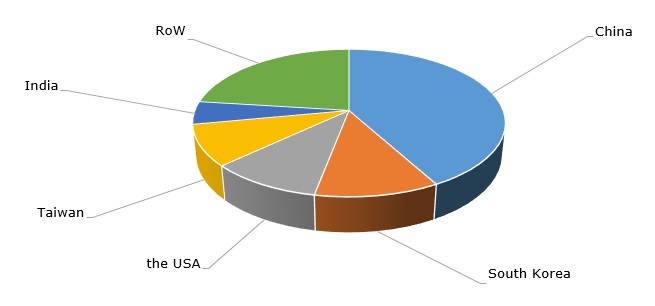

Structure of global PTA output by country

The above-mentioned complexity of the PTA production chain also leads to its vulnerability. For instance, the PTA-manufacturing issues at Alpek’s 500,000 mty PTA plant at Altamira (Mexico) resulted in the reduction of PTA supply in the North American region in Q3 2018. The issues were caused by a fire at the plant in July 2018. This impacted other PTA-consuming entities in the region. The situation with PTA supplies in the region issues was exacerbated by manufacturing problems of BP Chemicals’ PTA production at that time. PTA produced at the Altamira plant is supplied to PET resin facilities in Mexico and the USA, as well to other South American and European polyester producers. Alpek, being a vertically integrated company and one of Mexico’s largest global industrial companies, operates the PET resin plants (via its subsidiary DAK Americas) in the American states of North and South Carolina, Mississippi, and Columbia, as well as in Mexico and Argentina. Therefore, the whole production chain was affected after the Altamira plant’s fire. However, this vertical integration also means a benefit as Alpek has three PTA plants in Mexico and one in Brazil, which means that the issues at one plant, no matter how serious, may not be disastrous as other facilities may back up its PTA delivery system.

More information on the global terephthalic acid (PTA) can be found in the in-demand research report “Terephthalic Acid (PTA): 2018 World Market Outlook and Forecast up to 2027”.