Acetic acid is an important large-volume chemical, which acts as a building block in complex manufacturing and commodity chains. These chains involve petroleum-based raw materials, multiple intermediate chemicals and a wide range of end-products, like solvents, adhesives, soft drink bottles, synthetic fibres, fabrics, to name only a few. With respect to the manufacturing process and employed feedstock, acetic acid production pathways can vary a lot, subject to multiple economic, market and technological factors. Acetic acid could use, for instance, both ethanol and methanol as feedstocks. When moving further downstream along these chains, the intermediate product variability is also large. Such intermediate products include vinylacetate monomer or VAM (VAM accounts for over 35% of the global acetic acid consumption), acetate esters, like ethyl acetate or ETAC, (esters account for 15-20% of acetic acid consumption), acetic anhydride (another major acetic acid outlet with 15-20% of its consumption), polyvinyl acetate, polyvinyl alcohol, polyethylene terephthalate, etc.

The basic dynamic of the acetic acid market is predicated on its relationship between feedstock supply fluctuations and downstream demand (e.g. demand for EPAC). This interrelationship is multidimensional and depends on various factors and contexts. For instance, increase in upstream acetic acid prices due to its tight supply on the Asian market in early October 2018 (also driven by several factors) immediately reverberates in ethyl acetate (ETAC) market. When acetic acid supply improves in the absence of major turnarounds and buoyed by the capacity utilization rate build-up, with all other variables stable, the price for acetic acid may go down, which will be mirrored by downstream markets. The dynamic of the Asian acetic market may not be shared by other markets, despite the fact that Asian countries are leading acetic acid manufacturers.

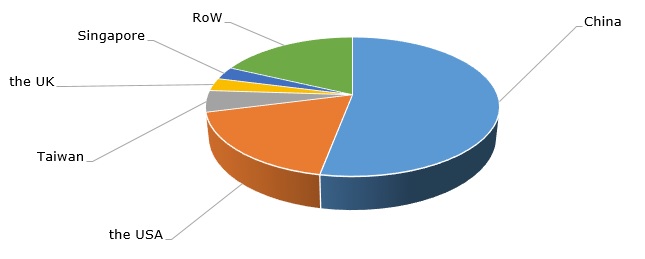

Main acetic acid producing countries

For instance, the same period in the US acetic acid market was characterised by ample supply and falling acetic acid costs, which eased off the situation on the US ETAC market. Acetic acid exports from China to the US were affected in round 3 of the trade war between China and the US. This round implied tariffs on $200bn worth of Chinese imports. On the contrary, European acetic acid prices in late Q3 and early Q4 2018 demonstrated a downward movement due to increased product availability and resistance from consuming sectors. Such cyclical nature of the global acetic acid market is evident in all sectors and regions.

More information on the global acetic acid market can be found in the insightful research study “Acetic Acid (AcOH): 2018 World Market Outlook and Forecast up to 2027”.