In early 2019, the ammonia market has been demonstrating a vivid bearish sentiment for several months now, though such kind of mood has been evident for a much longer period. The product oversupply, low margins, price volatility, flat consumption in many regions and environmental concerns have been tarnishing the ammonia industry for years.

For instance, in the case of ammonia oversupply, it will not be an exaggeration to ascertain that the available ammonia capacities are more than enough to cover the present demand for this product. However, many companies continue to expand its ammonia capacities. Approximately 30 new ammonia units were expected to come on-stream in 2017-2018 (some plans were not realised). One can mention just recent expansion plans of the following companies: Saudi Arabian Mining Company (Ma’aden) in Saudi Arabia, Togliatti Azot in Togliatti, Samara region, Russia (Togliatti Azot is Russia’s largest ammonia producer), Agrofert Group’s Duslo in Slovakia, and Linggu Chemical at Yixing City in China, to name just a few.

Of course, the construction of new ammonia facilities and expansion of existing lines is a multifaceted process. It is governed by multiple reasons, involves specific contexts (incl. regional) and has various outcomes, which do not necessarily lead to an over-supply. Just on the contrary, the expansion process is mostly guided by considerations of profitability, supply optimization, marketing, renovation, and modernization. For instance, in the case of Duslo, their previous plant was 45 years old and the inauguration of the new ammonia facility was a matter of survival. However, it is already clear that current levels of chemical production growth may have a detrimental effect on the environment. The changes in nitrogen use have become truly global due to the wicked problem of excess reactive nitrogen pollution and man-caused alteration of the N cycle. Ammonia, an important component in versatile agricultural uses, is a large source of nitrogen pollution. To this extent, the prospects of the ammonia market growth can be significantly undermined if its use in many agricultural applications is not optimised.

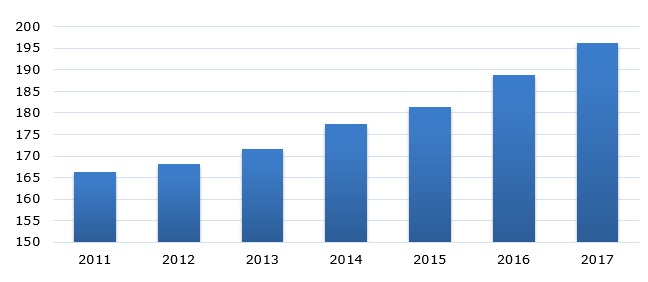

Global ammonia production during 2011-2017 (in million tonnes)

As such, a steady growth in the ammonia production may run contrary to the deteriorating environmental situation, which may require reviewing ammonia expansion plans coupled with the development of new technologies for optimization of its application. These technologies are available. However, environmental crisis can be mitigated only if changes are made in human behaviour, consumption patterns, regulation and other elements of the ammonia production system since it is clear that simple technocratic solutions are insufficient. The role of a business community and corporate sector in these changes is crucial.

More information on the global ammonia market can be found in the in-demand research report “Ammonia: 2019 World Market Outlook and Forecast up to 2028”.