Construction materials remain the major outlet for pumice, especially in the production of concrete admixtures/aggregates and lightweight building blocks. An economic recession can cause a downturn in the construction sector, thus weakening the demand for pumice and analogous building materials. Alternatively, an economic recovery, which often leads to a boost in the building activity, could be instrumental in increasing pumice consumption.

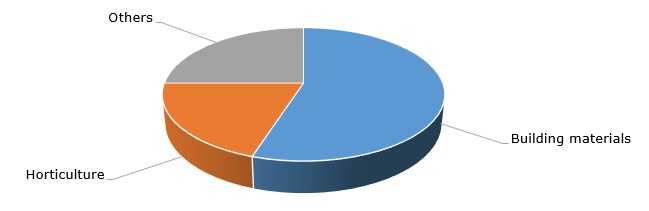

Pumice: structure of the global consumption by end-use sector

The current outlook for the construction industry, both globally and on its key regional markets, seems positive enough, despite fears of the next global recession and the upcoming Brexit. The prices for pumice products fluctuate a lot and vary substantially between different products and quantities orders. Moreover, the pumice market leaders operate by tuning in their products to exact specifications of individual projects as needed by their customers. One of the main factors driving current prices up is the increasing costs of mining and production operations.

Another important factor, which stimulates the market for pumice, is continuous research in the development of new building materials and their subsequent commercialization. This is a powerful trend dictated by both commercial motivation and environmental concerns since the production of many construction materials is an energy-intensive activity and a significant source of greenhouse gas and other emissions. For instance, pumice-based aggregates are developed as crushed stone substitutes in the production of lightweight concrete. Lightweight pumice concrete is known to be highly elastic; it also provides a much higher insulation value than standard aggregates or standard concrete mixes.

More information on the global pumice market can be found in the in-demand research report “Pumice: 2020 World Market Review and Forecast to 2029”.