The current and future behaviour of the chemical market and many related markets remain unpredictable when such expressions as nationwide lockdown and aggressive quarantine measures are getting firmly entrenched in daily activities. The coronavirus outbreak, in combination with other factors, is leading to a significant economic recession of the global and regional economies. Its multiple consequences and feedbacks are only starting to unfold, including severe shocks to social, healthcare, transportation, financial, and other provisioning systems. This has and will have a detrimental impact on the chemical industry.

Against this dramatic background, the trajectory of the global ammonium market is marked with lots of uncertainties. The recent blow to the ammonia market has come just recently when Indian Prime Minister Narendra Modi declared a 21-day nationwide lockdown. Despite the fact that the Indian transportation system continues to function within the country, it means that many chemical facilities, including ammonium plants, will be affected. India is a major ammonia-consuming and -producing region, with a significant share of planned ammonium capacity additions in the coming years. It is clear that many of these plans of Indian ammonium manufacturers might be reconsidered, confronted by the demand weakening and imminent economic recession. For instance, large ammonium capacity expansion was planned by Indian Farmers Fertiliser Cooperative Limited at its Kalol plant in 2021 (the plant’s ammonia output in 2018/2019 was 379 thous. mty).

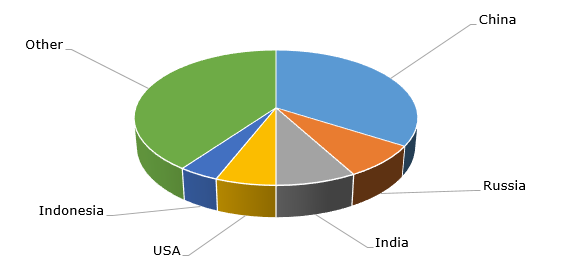

Ammonia: structure of the global capacity by country

Many analysts predict a major drop in the ammonia demand from industrial customers. Ammonia is used in metal treating operations, nitric acid manufacture, petrochemical processes, refrigeration systems, household cleaning agents, to name just a few. However, analysts are not certain about the scenarios of ammonia consumption in the agricultural sector. It seems that the need for food products is ubiquitous but the disruptions of the supply chains are highly likely and the ammonia consumption in the agricultural sector might spiral down too.

Despite these perils and ongoing disruptions, many ammonia-producing companies staunchly continue their operations, manufacturing important commodities. For instance, Yara, one of the world’s largest ammonia manufacturers with over 9 mln mty capacity, acts in such a vein. Of course, the pandemic took its toll as, for instance, Yara’s projects in Brazil (Salitre phosphate project and Rio Grande NPK fertiliser expansion project) halted as a result of general COVID-19 measures announced by Brazilian authorities. However, the company took a three-tier corporate responsibility approach: it takes care of its personnel health, strictly adheres to the general healthcare system guidelines and maintains current operational levels, manufacturing essential products for agribusiness and society.

A possible bright spot for the current ammonia market may be the decrease in prices for natural gas. Following the oil price trajectory, the decline in natural gas prices could support ammonia production in these turbulent times.

More information on the global ammonia market can be found in the comprehensive research study “Ammonia: 2020 World Market Outlook and Forecast up to 2029”.