It goes without saying that the present situation on the aromatics market is heavily affected by the global economic recession caused by the Covid-19 pandemic. The main substances of the aromatics groups (benzene, toluene, and xylenes) are used as vital ingredients in the production of various products, including octane-enhancing fuel additives, building materials, paints, adhesives, vehicle components, furniture, consumer appliances, fabrics, electronic equipment, etc. All these sectors, including the upstream and downstream petroleum sectors, are now adversely impacted. They are plagued by significant drops in sales volumes and operating rates. Their production, distribution channels, storage capacity, and provisioning systems are disrupted. There are multiple cases of job redundancies. The general economic, political, and social uncertainty is the current reality. The provided and promised support packages would hardly allow for quick recovery of these sectors, which definitely renders a major negative impact on the benzene market.

Against this dramatic background, things may be deteriorated by the traditional slowdown in demand for benzene seen over the summer months. However, this may be partially offset by the rise in the demand for octane-boosting aromatics, which is indispensable in gasoline with a lower Reid vapor pressure to combat fuel volatility and evaporation in hot summer months.

Currently, benzene prices remain at their record low values, buoyed by the fact that almost all aromatics products have their origins in crude oil. However, the slow return from multiple lockdowns worldwide will likely invigorate the benzene-consuming markets and raise benzene prices, which have been always marked by significant volatility backed by overcapacity. Benzene prices have already demonstrated a number of spikes in Asia and North America. The existing global benzene production capacity exceeds 60 mln tonnes per year against the benzene output volume of about 45 mln tonnes per year.

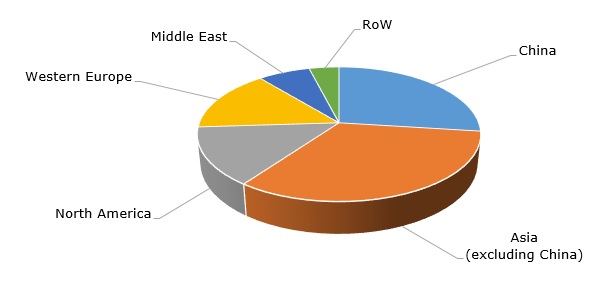

Benzene: structure of the global production by region

It is clear that the future benzene market behaviour is also predicated on further development of the coronavirus pandemic and availability of Covid-19 vaccines and treatment. It seems that the virus presently demonstrates seasonal summer retreat, though a possibility of its repetitive waves remains. Other factors, mainly a general urge to make different industrial sectors “greener”, are instrumental in lowering the overall demand for petroleum products. Their sales are likely to decrease, while existing oil refinery capacities, especially in Europe, are likely to shrink or transform to produce other petroleum products.

However, macroeconomic factors may not provide the full picture of how individual manufacturers of petroleum products perform overall. These manufacturers are highly diversified vertically integrated multinational companies. In the current critical situation, these companies have some room for manoeuvre. For instance, Borealis divides its activities by three major sectors, namely polyolefins, base chemicals and fertilisers. If its base chemicals sector (e.g. Borealis’ benzene-producing facility in Porvoo, Finland) may not perform well, this can be offset by the company’s strong performance in the fertilizer sector.

More information on the global benzene market can be found in the in-demand research study “Benzene: 2020 World Market Outlook and Forecast up to 2029”.