The market for various copolymers of ethylene (ethene) with vinyl acetate is characterised by a significant degree of functional versatility owing to the intrinsic characteristics of these copolymers. Ethylene-vinyl acetate copolymers (EVA) can feature different ratios of monomers. So, modification of vinyl acetate content allows chemical manufacturers to adjust the product’s rigidity, tensile strength, stretchability, and other parameters, thus producing customised items for specific needs. For instance, 1-10% content of vinyl acetate, (which means higher rigidity and stiffness), is suitable for such applications as garden hoses, films, pipes, etc., whereas 30-40% content of vinyl acetate is appropriate for coatings and adhesives, while 40-90% content, (which means higher shock resistance and flexibility), gives a perfect ratio for the production of elastomers. As such, well-known EVA brands, like Dow’s ELVAX (former DuPont’s), LyondellBasell’s ULTRATHENE, ExxonMobil’s ESCORENE and NEXXSTAR, Celanese’s ATEVA, Formosa Plastics Corp.’s TAISOX or Arlanxeo/Saudi Aramco’s LEVAPREN (former Bayer’s), act as names for extensive product lines. In addition, the market for ethylene-vinyl acetate copolymers is supported by their utilization in emerging and prospective applications, like the use of luminescent EVA copolymer films for enhancing the conversion efficiency of solar cells in the photovoltaic industry.

Ethylene-vinyl acetate copolymer manufacturing can be merged with the production of other chemicals, like low-density polyethylene (LDPE), in the format of swing plants. For example, Formosa Plastics Corp. operates a 270k mty EVA/LDPE swing plant in Mailiao, Taiwan (the plant has been recently restarted following a planned technical turnaround). Likewise, China’s BASF-YPC, a joint venture between BASF and Sinopec, runs a 400k mty LDPE/EVA swing plant in Nanjing, Jiangsu, China.

The aforementioned flexibility of technological processes (either tubular or autoclave) and versatility of copolymer applications act as an effective instrument against the disastrous consequences of the coronavirus pandemic. Whereas some sectors, like the mobility and automotive industry, continue to struggle, others are on track for steady recovery or demonstrate stable growth, like packaging and medical applications.

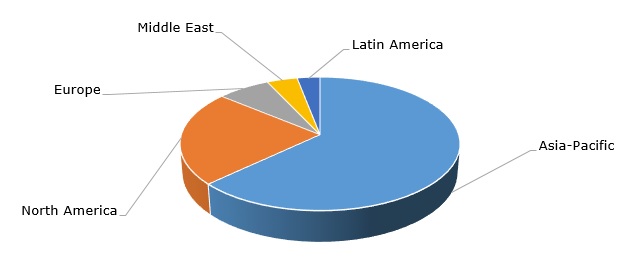

Global ethylene-vinyl acetate production capacity by region

Different EVA geographic markets exhibit various rates of recovery, with China showing the most positive dynamics. The US market, the second-largest EVA market in the world, is currently in the state of uncertainty, with some product requests being canceled and shipments being rescheduled. It is clear that in the ongoing difficult pandemic situation in the US when businesses are still wary about the start of the economy reinvigoration, it is difficult to foresee the existing levels of demand and plan operational activities. For instance, LyondellBasell closely monitors the current market situation, while all of its major global manufacturing sites remain operational. LyondellBasell is a major EVA manufacturer with a 300k mty EVA facility. Apart from that, it is a supplier/licensor of proprietary EVA/LDPE production technologies known as Lupotech T tubular technology and Lupotech A autoclave technology. Selling such technologies to different regional EVA markets helps to overcome the pandemic by creating additional revenue streams.

Find more information on the global ethylene-vinyl acetate market performance and trends in the in-demand research report “Ethylene Vinyl Acetate (EVA): 2020 World Market Outlook and Forecast up to 2029”.